"Unlock Financial Freedom with a Quick 1000 Loan Bad Credit: Your Guide to Fast Cash Solutions"

Guide or Summary:Introduction to Quick 1000 Loan Bad CreditUnderstanding Quick 1000 Loan Bad Credit OptionsBenefits of Quick 1000 Loan Bad CreditHow to Appl……

Guide or Summary:

- Introduction to Quick 1000 Loan Bad Credit

- Understanding Quick 1000 Loan Bad Credit Options

- Benefits of Quick 1000 Loan Bad Credit

- How to Apply for a Quick 1000 Loan Bad Credit

- Considerations Before Applying for a Quick 1000 Loan Bad Credit

Introduction to Quick 1000 Loan Bad Credit

In today's fast-paced world, financial emergencies can arise unexpectedly. Whether it's a medical bill, car repair, or an urgent home expense, having access to quick cash can be crucial. For individuals with less-than-perfect credit histories, finding a reliable source of funds can be challenging. However, a **quick 1000 loan bad credit** can provide the financial relief needed without the lengthy approval processes typical of traditional loans.

Understanding Quick 1000 Loan Bad Credit Options

A **quick 1000 loan bad credit** is designed specifically for individuals who may have faced financial difficulties in the past. These loans typically offer a fast approval process, allowing borrowers to receive funds within a short timeframe, often as quickly as the same day. Lenders who provide these loans understand that credit scores do not always reflect a person's current financial situation or their ability to repay a loan.

Benefits of Quick 1000 Loan Bad Credit

1. **Fast Approval Process**: One of the primary advantages of a **quick 1000 loan bad credit** is the speed at which funds are made available. Many lenders offer online applications that can be completed in minutes, with approvals often granted within hours.

2. **Accessible to Many Borrowers**: Unlike traditional loans that may require a high credit score, a **quick 1000 loan bad credit** is accessible to a broader range of borrowers. Lenders typically look at other factors, such as income and employment status, rather than solely relying on credit scores.

3. **Flexible Use of Funds**: Borrowers can use the funds from a **quick 1000 loan bad credit** for various purposes, including unexpected bills, home repairs, or even consolidating other debts. This flexibility allows individuals to address their most pressing financial needs.

How to Apply for a Quick 1000 Loan Bad Credit

Applying for a **quick 1000 loan bad credit** is a straightforward process. Here are the steps to follow:

1. **Research Lenders**: Start by researching lenders that specialize in bad credit loans. Look for reputable companies with positive customer reviews and transparent terms.

2. **Complete the Application**: Most lenders offer an online application form. Fill out the required information, including your personal details, income, and the amount you wish to borrow.

3. **Submit Documentation**: Some lenders may require additional documentation, such as proof of income or identification. Be prepared to provide these documents to expedite the process.

4. **Review Loan Terms**: Once approved, carefully review the loan terms, including interest rates and repayment schedules. Ensure that you understand the total cost of the loan before accepting.

5. **Receive Funds**: After accepting the loan, funds are typically deposited directly into your bank account, allowing you to address your financial needs promptly.

Considerations Before Applying for a Quick 1000 Loan Bad Credit

While a **quick 1000 loan bad credit** can be a helpful financial tool, it's essential to consider a few factors before proceeding:

1. **Interest Rates**: Loans for individuals with bad credit often come with higher interest rates. Ensure that you are comfortable with the repayment terms and that they fit within your budget.

2. **Repayment Terms**: Understand the repayment schedule and make sure you can meet the deadlines to avoid additional fees or penalties.

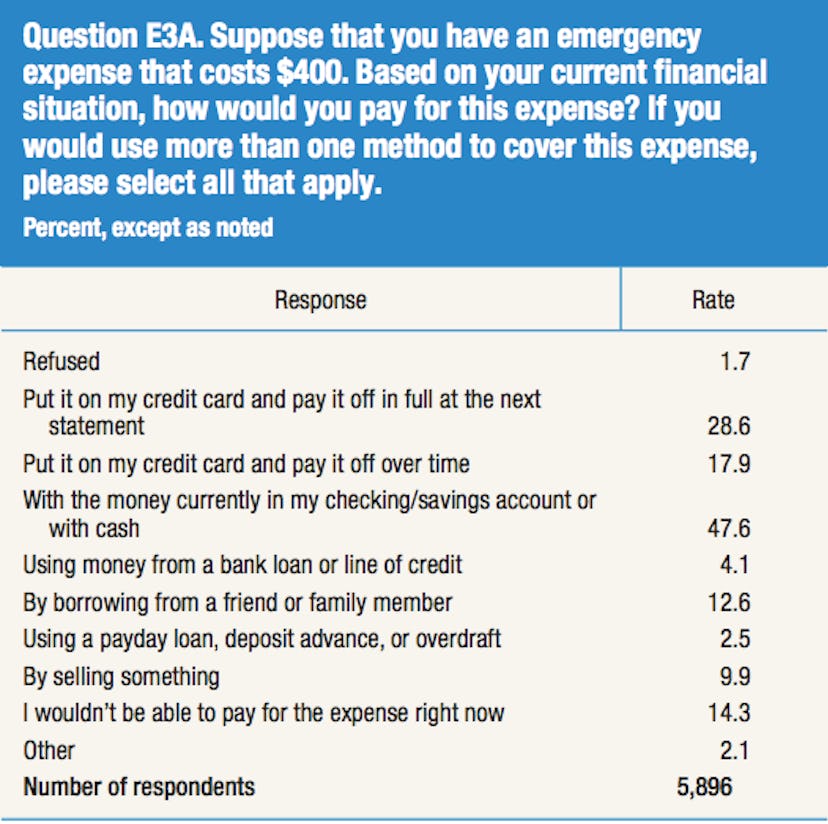

3. **Alternative Options**: Before committing to a loan, explore other options such as payment plans, community assistance programs, or borrowing from friends and family.

A **quick 1000 loan bad credit** can provide a lifeline for those facing unexpected financial challenges. By understanding the application process, benefits, and considerations, borrowers can make informed decisions that align with their financial needs. Remember to choose a reputable lender, review all terms carefully, and ensure that you can manage the repayment to maintain your financial health. With the right approach, a quick loan can help you navigate through tough times and regain control of your finances.