"How to Effectively Estimate Loan Amounts for Your Financial Needs"

#### Understanding Estimate LoanEstimating a loan is a crucial step in the financial planning process. It involves calculating the amount of money you can b……

#### Understanding Estimate Loan

Estimating a loan is a crucial step in the financial planning process. It involves calculating the amount of money you can borrow based on your financial situation, creditworthiness, and the purpose of the loan. Whether you are looking to buy a home, finance a car, or cover unexpected expenses, having a clear estimate of the loan amount you can obtain will help you make informed decisions.

#### Factors to Consider When Estimating a Loan

When estimating a loan, several factors come into play. First, your credit score is one of the most significant determinants of how much you can borrow. Lenders use this number to evaluate your creditworthiness. A higher credit score usually translates to better loan terms and a larger borrowing capacity.

Next, your income and employment status are critical. Lenders want to ensure that you have a stable source of income to repay the loan. They will often look at your debt-to-income ratio, which compares your monthly debt payments to your gross monthly income. A lower ratio indicates that you have a manageable level of debt, making you a more attractive candidate for a loan.

Additionally, the type of loan you are seeking will affect your estimate. For example, mortgage loans typically have different requirements and limits compared to personal loans or auto loans. Understanding the specifics of the loan type you need will help you gauge how much you can realistically borrow.

#### Using Online Tools to Estimate Loan Amounts

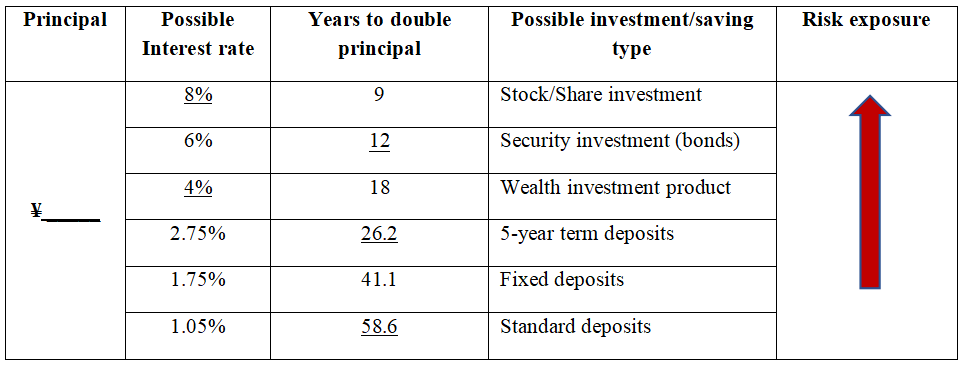

In today's digital age, numerous online calculators and tools can help you estimate your loan amount. These tools typically require you to input your income, expenses, credit score, and other relevant information. The calculator then provides an estimate of how much you can borrow and what your monthly payments might look like.

Using these online resources can save you time and provide a preliminary understanding of your borrowing capacity. However, it is essential to remember that these estimates are not definitive. They serve as a guideline, and actual loan offers may vary based on lender policies and market conditions.

#### Consulting with Financial Advisors

For a more personalized estimate, consider consulting with a financial advisor or a mortgage broker. These professionals can provide insights tailored to your specific financial situation. They can help you understand the nuances of different loan products and guide you in choosing the best option for your needs.

A financial advisor can also assist you in preparing your financial documents, ensuring that you present the best possible case to lenders. This preparation can lead to more favorable loan terms and a higher estimated loan amount.

#### Conclusion: The Importance of Accurate Loan Estimation

Estimating a loan is not just about knowing how much money you can borrow; it’s about understanding your financial capabilities and responsibilities. A well-thought-out estimate can pave the way for smarter financial decisions, enabling you to secure the funding you need without overextending yourself.

By considering factors such as your credit score, income, and the type of loan, utilizing online tools, and consulting with professionals, you can effectively estimate the loan amount that aligns with your financial goals. Always remember that accurate loan estimation is the first step toward a successful borrowing experience.