Understanding the Student Loan Grace Period: What You Need to Know for Financial Planning

#### Student Loan Grace PeriodThe student loan grace period is a crucial aspect of managing student debt that every borrower should be aware of. This period……

#### Student Loan Grace Period

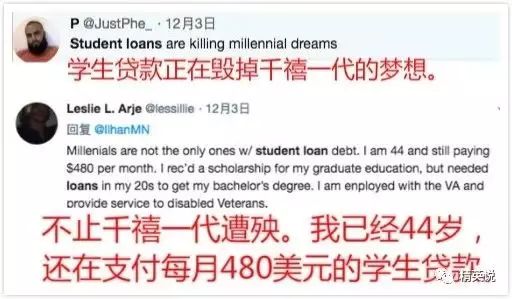

The student loan grace period is a crucial aspect of managing student debt that every borrower should be aware of. This period refers to the time after graduation, leaving school, or dropping below half-time enrollment during which you are not required to make payments on your federal student loans. Typically lasting for six months, this grace period allows graduates to transition into the workforce without the immediate burden of loan payments. However, understanding the intricacies of the student loan grace period is essential for effective financial planning.

During the student loan grace period, interest may still accrue on certain types of loans. For example, if you have unsubsidized federal loans or private loans, interest will accumulate during this time, adding to the overall cost of your debt. Conversely, subsidized federal loans do not accrue interest during the grace period, which can significantly affect your repayment strategy. It is crucial to check the specifics of your loans to understand how the grace period will impact your financial situation.

#### Importance of the Student Loan Grace Period

The student loan grace period serves several important functions. Firstly, it provides recent graduates with a buffer period to secure employment and establish a stable income before beginning their repayment journey. This can alleviate financial stress and allow graduates to focus on finding a job that aligns with their career aspirations.

Secondly, the student loan grace period is an excellent opportunity for borrowers to educate themselves about their loan options, repayment plans, and potential forgiveness programs. Many borrowers are unaware of the various repayment options available to them, such as income-driven repayment plans or loan consolidation, which can significantly affect their financial obligations. Utilizing the grace period to research these options can lead to more informed decisions and potentially lower monthly payments.

#### Strategies During the Grace Period

To maximize the benefits of the student loan grace period, borrowers should consider implementing several strategies. Firstly, it is advisable to start budgeting and saving during this time. Even though payments are not required, setting aside money can help ease the transition into repayment and create a financial cushion for unexpected expenses.

Additionally, borrowers should consider making voluntary payments during the grace period. By paying off the interest that accrues on unsubsidized loans, borrowers can prevent their loan balance from increasing, ultimately saving money in the long run. This proactive approach can also help borrowers get into the habit of making regular payments, making the transition to repayment smoother.

#### Conclusion

In conclusion, the student loan grace period is a vital time for new graduates to prepare for the financial responsibilities that come with student loans. By understanding the terms of their loans, exploring repayment options, and implementing effective strategies, borrowers can navigate this period successfully. It is essential for graduates to take full advantage of the grace period to ensure a smooth transition into repayment and to lay the groundwork for a stable financial future. Being informed and proactive during this time can make all the difference in managing student debt effectively.