Unlocking Your Dream Vehicle: A Comprehensive Guide to the $30,000 Car Loan Calculator

Guide or Summary:Understanding the $30,000 Car Loan CalculatorWhy Use a $30,000 Car Loan Calculator?How to Use the $30,000 Car Loan CalculatorFactors Influe……

Guide or Summary:

- Understanding the $30,000 Car Loan Calculator

- Why Use a $30,000 Car Loan Calculator?

- How to Use the $30,000 Car Loan Calculator

- Factors Influencing Your Car Loan

- Conclusion: Making Informed Decisions with the $30,000 Car Loan Calculator

Understanding the $30,000 Car Loan Calculator

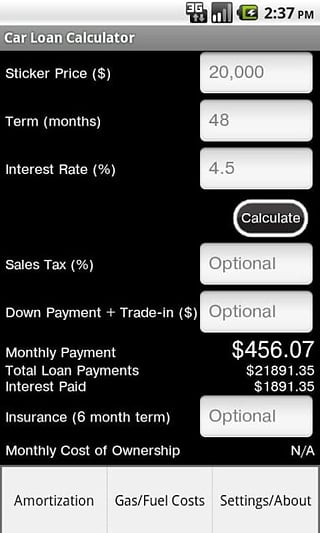

When it comes to purchasing a vehicle, understanding your financing options is crucial. One of the most effective tools at your disposal is the $30,000 car loan calculator. This online resource allows potential car buyers to estimate their monthly payments, total interest paid, and the overall cost of the loan. By inputting various parameters such as loan amount, interest rate, and loan term, you can gain valuable insights into what you can afford and how to structure your loan to fit your budget.

Why Use a $30,000 Car Loan Calculator?

Using a $30,000 car loan calculator offers several advantages. First and foremost, it helps you plan your finances effectively. By calculating different scenarios, you can see how changes in interest rates or loan terms affect your monthly payments. This flexibility enables you to make informed decisions about your vehicle purchase without being blindsided by unexpected costs.

Moreover, understanding your loan details can empower you during negotiations with dealerships or lenders. When you know what to expect in terms of monthly payments, you can confidently discuss financing options and avoid being upsold on unnecessary features or extended warranties.

How to Use the $30,000 Car Loan Calculator

To make the most out of the $30,000 car loan calculator, follow these simple steps:

1. **Input the Loan Amount**: Start with the total amount you plan to borrow, which in this case is $30,000.

2. **Set the Interest Rate**: The interest rate can vary based on your credit score, the lender, and current market conditions. Research average rates to input a realistic figure.

3. **Determine the Loan Term**: Decide how long you want to take to repay the loan. Common terms are 36, 48, or 60 months.

4. **Calculate**: Hit the calculate button to see your estimated monthly payment, total interest paid, and total cost of the loan.

5. **Adjust Parameters**: Experiment with different interest rates and loan terms to find the best fit for your financial situation.

Factors Influencing Your Car Loan

Several factors can influence the outcome of your $30,000 car loan calculator results. These include:

- **Credit Score**: A higher credit score typically qualifies you for lower interest rates, which can significantly reduce your monthly payments and total interest paid.

- **Down Payment**: The amount you put down upfront can also affect your loan terms. A larger down payment reduces the total amount financed, leading to lower monthly payments.

- **Loan Type**: Different types of loans (e.g., secured vs. unsecured) can have varying interest rates and terms. Researching these options can help you make a more informed decision.

- **Lender Policies**: Different lenders offer different rates and terms, so it’s wise to shop around and compare offers before committing.

Conclusion: Making Informed Decisions with the $30,000 Car Loan Calculator

In conclusion, the $30,000 car loan calculator is an invaluable tool for anyone looking to finance a vehicle. By providing a clear picture of your potential loan terms, it empowers you to make informed decisions that align with your financial goals. Whether you're a first-time buyer or a seasoned car owner, leveraging this calculator can lead to smarter purchasing decisions, ultimately saving you money in the long run. So, before you head to the dealership, take a moment to utilize the $30,000 car loan calculator and set yourself up for success in your car-buying journey.