Does a Car Loan Build Credit? Discover the Secrets to Boosting Your Credit Score with Auto Financing

Guide or Summary:Does a Car Loan Build Credit?Understanding Credit ScoresHow a Car Loan Can Build CreditFactors to ConsiderTips for Using a Car Loan to Buil……

Guide or Summary:

- Does a Car Loan Build Credit?

- Understanding Credit Scores

- How a Car Loan Can Build Credit

- Factors to Consider

- Tips for Using a Car Loan to Build Credit

Does a Car Loan Build Credit?

When it comes to improving your credit score, many people wonder, "Does a car loan build credit?" The answer is a resounding yes! Taking out a car loan can be an effective way to enhance your credit profile, provided you manage it wisely. In this article, we will explore how auto financing can impact your credit score, the factors that influence your credit rating, and tips for using a car loan to your advantage.

Understanding Credit Scores

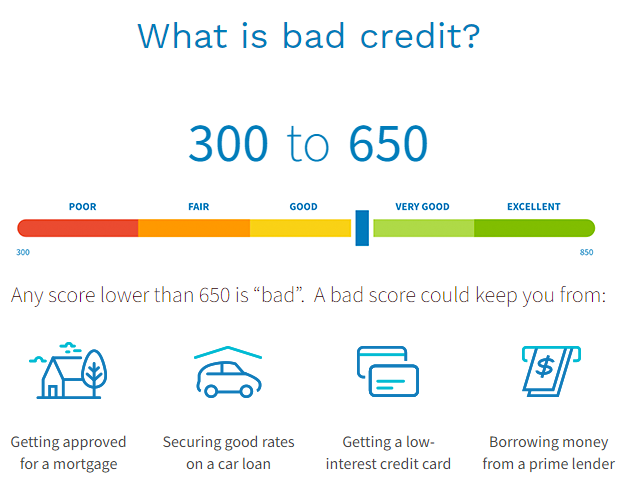

Before diving into how a car loan affects your credit, it's essential to understand what a credit score is. Credit scores typically range from 300 to 850, with higher scores indicating better creditworthiness. Lenders use these scores to assess the risk of lending money to you. Your credit score is influenced by several factors, including payment history, amounts owed, length of credit history, new credit, and types of credit used.

How a Car Loan Can Build Credit

When you take out a car loan, you are essentially adding an installment loan to your credit profile. This can positively impact your credit score in several ways:

1. **Payment History**: Your payment history accounts for 35% of your credit score. Making timely payments on your car loan demonstrates to lenders that you are responsible with your finances. Consistently paying on time can significantly boost your credit score.

2. **Credit Mix**: Having a diverse mix of credit types (such as credit cards, mortgages, and installment loans) can positively influence your score. A car loan adds to this mix, showing lenders that you can handle different types of credit responsibly.

3. **Credit Utilization**: Although this factor is more relevant for revolving credit (like credit cards), having a car loan can help maintain a lower overall utilization ratio by spreading out your debt across various types of credit.

Factors to Consider

While a car loan can build credit, there are several factors to keep in mind:

- **Loan Amount**: The size of the loan can impact your credit utilization ratio. A larger loan may affect your score more significantly if not managed correctly.

- **Interest Rates**: Higher interest rates can lead to larger payments, which may make it more challenging to stay current on your loan.

- **Loan Term**: The length of your loan can affect your credit score. Longer terms may result in lower monthly payments, but you might pay more in interest over time.

Tips for Using a Car Loan to Build Credit

If you decide to take out a car loan to build your credit, consider the following tips:

1. **Shop Around**: Compare interest rates from different lenders to find the best deal. A lower interest rate can save you money and make it easier to pay on time.

2. **Budget Wisely**: Ensure that you can comfortably afford the monthly payments. A budget will help you manage your finances and avoid missed payments.

3. **Make Payments on Time**: Always pay your loan on time. Setting up automatic payments can help ensure you never miss a due date.

4. **Monitor Your Credit**: Regularly check your credit report to track your progress and ensure there are no inaccuracies that could negatively affect your score.

In conclusion, the question "Does a car loan build credit?" has a clear answer: yes, it can! By responsibly managing your car loan, making timely payments, and maintaining a good credit mix, you can significantly boost your credit score. Remember to consider all factors involved and take proactive steps to ensure your auto financing experience contributes positively to your financial future. Whether you're looking to buy a new car or simply want to improve your credit, a car loan can be a valuable tool in your financial arsenal.