## How Much Should I Take Out for Student Loans: A Comprehensive Guide to Making Informed Financial Decisions

Navigating the world of student loans can feel overwhelming, especially when it comes to determining the right amount to borrow. If you're asking yourself……

Navigating the world of student loans can feel overwhelming, especially when it comes to determining the right amount to borrow. If you're asking yourself, "How much should I take out for student loans?" you're not alone. Many students face this critical question as they prepare for their educational journey. In this guide, we will delve into the factors you need to consider when deciding how much to borrow, ensuring you make informed financial decisions that will set you up for success.

### Understanding Your Educational Costs

Before you can answer the question of how much you should take out for student loans, it's essential to understand the total cost of your education. This includes not only tuition but also fees, books, supplies, and living expenses. Research your chosen institution's cost structure, and consider additional expenses like transportation and personal costs. By having a clear picture of your total educational costs, you can better assess how much you need to borrow.

### Evaluating Your Financial Situation

Next, take a close look at your financial situation. This involves assessing your savings, family contributions, and any scholarships or grants you may have received. The goal is to minimize the amount you need to borrow. By understanding your financial resources, you can make a more informed decision about how much to take out in student loans.

### The Importance of Budgeting

Creating a budget is a crucial step in the loan process. A budget helps you track your income and expenses, ensuring you don’t borrow more than you can afford to repay. When considering how much to take out for student loans, factor in your anticipated monthly payments after graduation. Use online calculators to estimate your monthly loan payments based on different borrowing amounts and interest rates. This will give you a clearer idea of what you can realistically afford.

### The Impact of Interest Rates

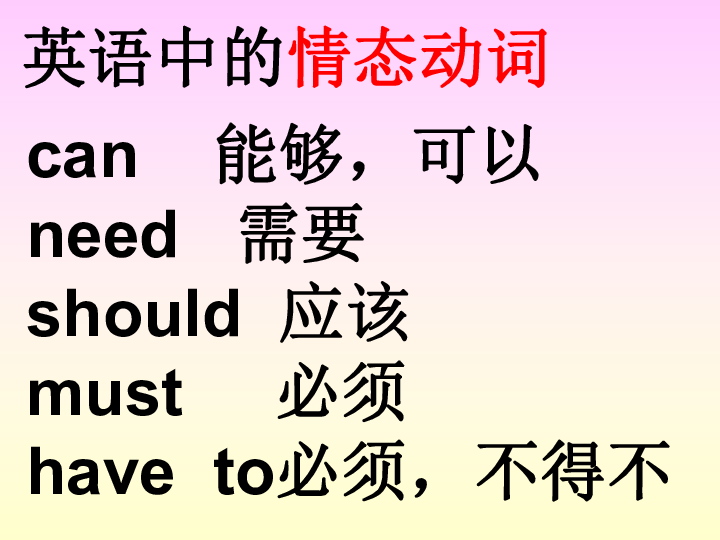

Interest rates significantly affect how much you should borrow. Federal student loans typically have lower interest rates compared to private loans. Understanding the difference between these types of loans can help you make a more informed decision. If you’re considering private loans, shop around for the best rates and terms. The lower the interest rate, the less you’ll pay over the life of the loan, which can influence how much you decide to borrow.

### Long-Term Financial Implications

When asking yourself, "How much should I take out for student loans?" consider the long-term implications of your borrowing decisions. Student loans are a long-term financial commitment, and the amount you borrow will impact your financial future. Aim to borrow only what you need, as excessive borrowing can lead to financial strain after graduation. Consider your career prospects and potential salary in your chosen field. This can help you gauge how much debt you can realistically manage.

### Seeking Financial Aid Counseling

If you're still unsure about how much to take out for student loans, consider seeking advice from a financial aid counselor at your school. They can provide personalized guidance based on your financial situation and educational goals. Additionally, many institutions offer workshops and resources to help students navigate the loan process.

### Conclusion

Deciding how much to take out for student loans is a significant decision that requires careful consideration. By understanding your educational costs, evaluating your financial situation, creating a budget, considering interest rates, and seeking professional advice, you can make a well-informed choice. Remember, borrowing wisely now can lead to a more secure financial future after graduation. Take the time to assess your needs and make the best decision for your educational journey.