Unlock Your Financial Potential with Hatch Loan: A Comprehensive Guide to Smart Borrowing

Guide or Summary:Understanding Hatch Loan: What You Need to KnowThe Benefits of Choosing Hatch LoanHow to Apply for a Hatch LoanRepaying Your Hatch Loan: Ti……

Guide or Summary:

- Understanding Hatch Loan: What You Need to Know

- The Benefits of Choosing Hatch Loan

- How to Apply for a Hatch Loan

- Repaying Your Hatch Loan: Tips for Success

- Conclusion: Is a Hatch Loan Right for You?

---

Understanding Hatch Loan: What You Need to Know

In today's fast-paced financial landscape, individuals often find themselves in need of quick and accessible funds. This is where the concept of a **Hatch Loan** comes into play. A Hatch Loan is designed to provide borrowers with the financial flexibility they need, whether it's for unexpected expenses, debt consolidation, or even funding a new venture. Understanding what a Hatch Loan entails is crucial for making informed financial decisions.

The Benefits of Choosing Hatch Loan

One of the primary advantages of a **Hatch Loan** is its accessibility. Unlike traditional loans that may require extensive credit checks and lengthy approval processes, Hatch Loans often come with more lenient eligibility criteria. This means that even individuals with less-than-perfect credit scores can still secure funding. Additionally, the application process is typically streamlined, allowing borrowers to receive funds quickly, often within a few days.

Another significant benefit is the flexibility that Hatch Loans offer. Borrowers can use the funds for various purposes, from covering medical bills to investing in personal projects. This versatility makes Hatch Loans a popular choice for many individuals looking to manage their finances more effectively.

How to Apply for a Hatch Loan

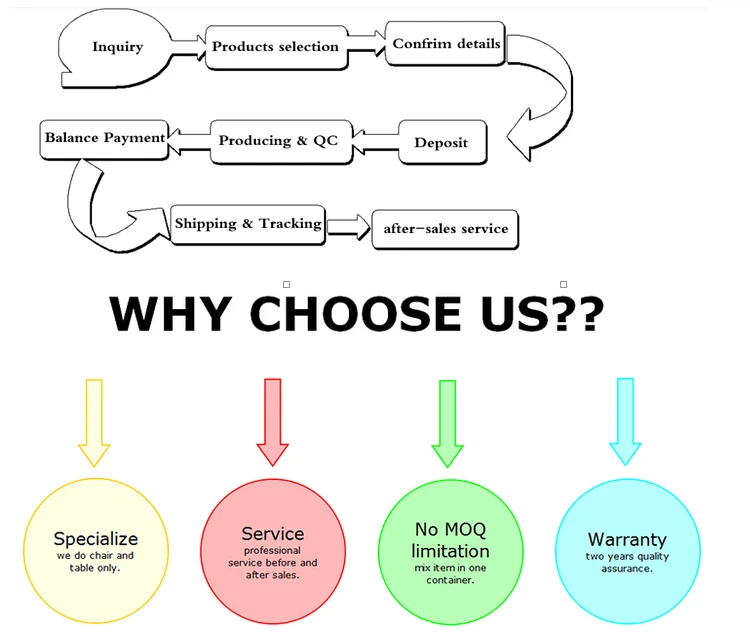

Applying for a **Hatch Loan** is a straightforward process. Most lenders offer online applications, which can be completed in just a few minutes. Here’s a step-by-step guide to help you navigate the application process:

1. **Research Lenders**: Start by researching different lenders that offer Hatch Loans. Look for reputable companies with positive customer reviews and transparent terms.

2. **Gather Necessary Information**: Before you apply, gather all necessary documentation, including proof of income, identification, and any other required information.

3. **Fill Out the Application**: Complete the online application form, providing accurate information about your financial situation and the amount you wish to borrow.

4. **Review Loan Terms**: Once approved, carefully review the loan terms, including interest rates, repayment schedules, and any fees associated with the loan.

5. **Receive Your Funds**: After signing the loan agreement, the funds will typically be deposited into your bank account within a few days.

Repaying Your Hatch Loan: Tips for Success

Repaying a **Hatch Loan** on time is essential for maintaining a healthy credit score and avoiding additional fees. Here are some tips to help you manage your repayments effectively:

- **Create a Budget**: Incorporate your loan repayments into your monthly budget to ensure you have enough funds set aside.

- **Set Up Automatic Payments**: Many lenders offer the option to set up automatic payments, which can help you avoid missed payments and late fees.

- **Communicate with Your Lender**: If you encounter financial difficulties, reach out to your lender. They may offer solutions such as deferment or restructuring your loan.

Conclusion: Is a Hatch Loan Right for You?

In conclusion, a **Hatch Loan** can be a valuable financial tool for those in need of quick funding. With its accessibility, flexibility, and straightforward application process, it’s an option worth considering. However, it’s essential to evaluate your financial situation and repayment capabilities before committing to any loan. By doing so, you can unlock your financial potential and make the most of what a Hatch Loan has to offer. Always remember to borrow responsibly and seek professional financial advice if needed.