### Unlock Your Dream Home: Understanding Construction Loan Mortgage Rates

When it comes to building your dream home from the ground up, understanding construction loan mortgage rates is crucial. These rates can significantly impac……

When it comes to building your dream home from the ground up, understanding construction loan mortgage rates is crucial. These rates can significantly impact your overall budget and the feasibility of your construction project. In this detailed guide, we'll explore what construction loan mortgage rates are, how they work, and tips on securing the best rates for your needs.

#### What Are Construction Loan Mortgage Rates?

Construction loan mortgage rates refer to the interest rates associated with loans specifically designed for financing the construction of a new home or major renovations. Unlike traditional mortgage rates, which apply to existing homes, construction loan rates can vary significantly based on several factors, including the type of loan, the lender, and the borrower's creditworthiness.

Typically, construction loans are short-term loans, lasting anywhere from six months to a few years, depending on the project's scope. During this period, borrowers often pay only interest on the loan, which can make it an attractive option for those looking to build.

#### Factors Influencing Construction Loan Mortgage Rates

1. **Credit Score**: Your credit score plays a vital role in determining your construction loan mortgage rates. Lenders typically offer lower rates to borrowers with higher credit scores, as they are viewed as lower risk.

2. **Loan Type**: There are various types of construction loans, including fixed-rate and variable-rate loans. Fixed-rate loans offer stability, while variable-rate loans may start with lower rates but can fluctuate over time.

3. **Loan-to-Value Ratio (LTV)**: The LTV ratio compares the loan amount to the appraised value of the property. A lower LTV ratio often results in better rates, as it indicates a lower risk for the lender.

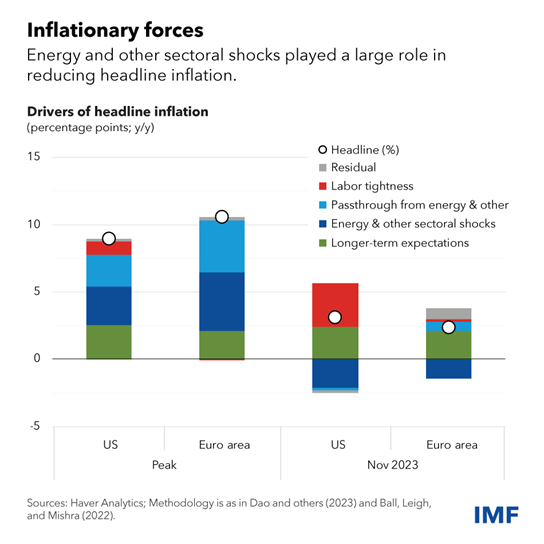

4. **Market Conditions**: Economic factors and market conditions can also influence construction loan mortgage rates. For instance, when the Federal Reserve raises interest rates, lenders typically follow suit, resulting in higher rates for borrowers.

#### How to Secure the Best Construction Loan Mortgage Rates

1. **Shop Around**: Don't settle for the first offer you receive. Different lenders can have vastly different rates and terms, so it’s essential to shop around and compare offers.

2. **Improve Your Credit Score**: If your credit score is less than stellar, take steps to improve it before applying for a construction loan. Pay down debts, make timely payments, and avoid opening new credit accounts.

3. **Consider a Larger Down Payment**: A larger down payment can lower your LTV ratio, which may help you secure a better interest rate. Aim for at least 20% if possible.

4. **Get Pre-Approved**: Obtaining pre-approval from lenders can give you a clearer picture of the rates you can expect and strengthen your position when negotiating.

5. **Work with a Mortgage Broker**: A knowledgeable mortgage broker can help you navigate the complexities of construction loans and connect you with lenders offering competitive rates.

#### Conclusion

Understanding construction loan mortgage rates is essential for anyone looking to build a new home or undertake major renovations. By grasping the factors that influence these rates and taking proactive steps to secure the best possible terms, you can make your dream home a reality without breaking the bank. Whether you’re a first-time builder or a seasoned homeowner, being informed about your financing options can lead to significant savings and a smoother construction process. Start your journey today by researching and comparing rates to find the ideal construction loan for your needs!