Lenders Online Loans: Your Ultimate Guide to Fast and Convenient Financing

Guide or Summary:Lenders online loans refer to financial products offered by various lending institutions that operate primarily through the internet. Unlik……

Guide or Summary:

When it comes to securing financial assistance in today's fast-paced world, the rise of lenders online loans has revolutionized the way individuals and businesses access funds. Whether you're facing unexpected expenses, looking to consolidate debt, or planning a major purchase, online loans offer a convenient and efficient solution. In this comprehensive guide, we will delve into the ins and outs of lenders online loans, exploring their benefits, types, application processes, and tips for finding the best options available.

### Understanding Lenders Online Loans

Lenders online loans refer to financial products offered by various lending institutions that operate primarily through the internet. Unlike traditional banks, which may require in-person visits and extensive paperwork, online lenders streamline the application process, allowing borrowers to access funds quickly and easily from the comfort of their homes. This digital approach has made it possible for many to secure loans without the hassle and delays often associated with conventional lending.

### Benefits of Online Loans

One of the primary advantages of lenders online loans is the speed at which funds can be accessed. Many online lenders offer same-day or next-day funding, which can be crucial in emergencies. Additionally, the application process is typically straightforward, often requiring only basic information such as income, employment status, and credit history. This simplicity appeals to borrowers who may not have the time or resources to navigate complex loan applications.

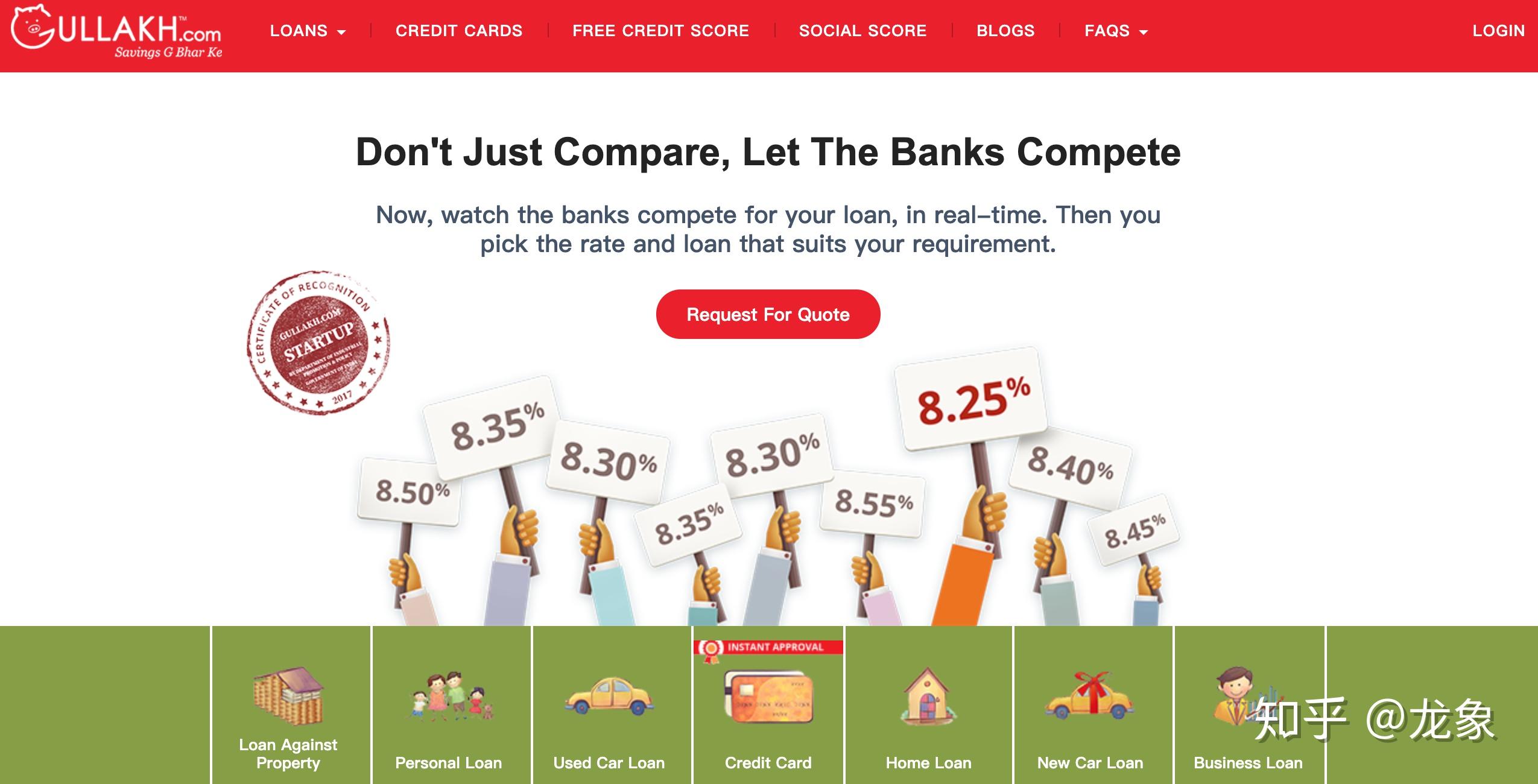

Another significant benefit is the increased accessibility of lenders online loans. Borrowers with varying credit scores can find options that suit their needs. Some online lenders specialize in offering loans to individuals with less-than-perfect credit, making it easier for a broader audience to obtain financing. Furthermore, the competitive nature of the online lending market often results in lower interest rates and better terms compared to traditional lenders.

### Types of Online Loans

There are several types of lenders online loans available to suit different financial needs. Personal loans are among the most common, providing borrowers with a lump sum that can be used for various purposes, such as home repairs, medical expenses, or travel. These loans typically have fixed interest rates and repayment terms, making budgeting easier.

Another popular option is payday loans, which are short-term, high-interest loans designed to cover immediate expenses until the borrower's next paycheck. While they can be helpful in emergencies, it's crucial to understand the risks associated with payday loans, including the potential for debt cycles if not managed properly.

For those looking to consolidate debt, many online lenders offer debt consolidation loans, allowing borrowers to combine multiple debts into a single loan with a lower interest rate. This can simplify payments and potentially save money in interest over time.

### The Application Process

Applying for lenders online loans is generally a straightforward process. Most lenders require the following steps:

1. **Research**: Start by comparing different online lenders to find the best rates and terms. Look for reviews and testimonials to gauge the lender's reputation.

2. **Pre-qualification**: Many lenders offer a pre-qualification process that allows you to see potential loan offers without affecting your credit score. This step can help you make an informed decision.

3. **Application**: Once you've chosen a lender, complete the online application form. Be prepared to provide personal information, including your income, employment details, and financial history.

4. **Approval**: After submitting your application, the lender will review your information. If approved, you'll receive a loan offer outlining the terms, including interest rates and repayment schedules.

5. **Funding**: Upon acceptance of the loan offer, funds can be disbursed quickly, often within one business day.

### Tips for Finding the Best Online Lenders

1. **Compare Rates**: Don't settle for the first offer. Compare rates from multiple lenders to ensure you're getting the best deal.

2. **Read the Fine Print**: Always review the loan agreement carefully to understand any fees, penalties, or interest rate changes.

3. **Check Reviews**: Look for feedback from past borrowers to gauge the lender's reliability and customer service.

4. **Understand Your Needs**: Assess your financial situation and determine how much you need to borrow and your ability to repay it.

In conclusion, lenders online loans provide a flexible and accessible way to secure financing for a variety of needs. By understanding the benefits, types, and application processes involved, you can make informed decisions that align with your financial goals. Whether you're in an emergency or planning for the future, online loans can be a valuable resource in your financial toolkit.