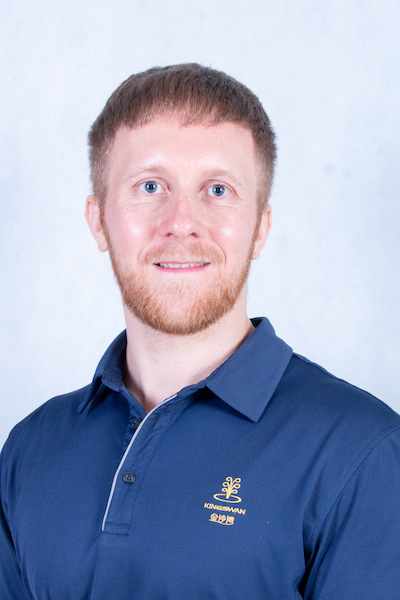

Josh Cohen Attorney Student Loan: Your Ultimate Guide to Navigating Student Loan Debt with Expert Legal Assistance

Navigating the complex world of student loans can be a daunting task for many graduates. With rising tuition costs and the burden of student debt, many indi……

Navigating the complex world of student loans can be a daunting task for many graduates. With rising tuition costs and the burden of student debt, many individuals find themselves overwhelmed and unsure of their options. This is where the expertise of a professional like Josh Cohen Attorney Student Loan comes into play. In this guide, we will explore how Josh Cohen, a seasoned attorney specializing in student loan issues, can help you manage your debt effectively and find the best solutions tailored to your unique situation.

### Understanding Student Loan Debt

Student loans have become a crucial part of higher education financing for millions of students across the United States. With the average graduate carrying over $30,000 in student debt, it is essential to understand the different types of loans available, including federal and private loans. Each type of loan comes with its own set of rules, repayment options, and potential for forgiveness. Unfortunately, many borrowers do not fully grasp their rights and responsibilities, leading to confusion and stress.

### Why Choose an Attorney?

The process of managing student loans can be intricate, especially when dealing with default, bankruptcy, or loan forgiveness programs. This is where an attorney like Josh Cohen Attorney Student Loan can make a significant difference. An experienced attorney can provide personalized advice on navigating the legal landscape of student loans, ensuring that you understand your options and rights.

### Services Offered by Josh Cohen

Josh Cohen offers a range of services that can assist individuals struggling with student loans. Here are some of the key areas where his expertise can be invaluable:

1. **Loan Consolidation and Refinancing**: For many borrowers, consolidating or refinancing their student loans can lead to lower monthly payments and reduced interest rates. Josh Cohen can help you understand the pros and cons of these options and guide you through the application process.

2. **Repayment Plans**: There are various repayment plans available for federal student loans, including income-driven repayment plans that adjust your monthly payments based on your income. An attorney can help you determine the best plan for your financial situation and assist with the application.

3. **Loan Forgiveness Programs**: Many borrowers are unaware of the various loan forgiveness programs available, such as Public Service Loan Forgiveness (PSLF). Josh Cohen can provide insights into eligibility requirements and help you navigate the application process.

4. **Default and Rehabilitation**: If you find yourself in default on your student loans, it can have serious consequences, including wage garnishment and tax refund seizures. An attorney can help you explore options for loan rehabilitation and negotiate with lenders to get you back on track.

5. **Bankruptcy and Student Loans**: While discharging student loans in bankruptcy is challenging, it is not impossible. Josh Cohen can evaluate your situation and determine if bankruptcy is a viable option for you.

### The Importance of Legal Representation

Having legal representation can be a game-changer when dealing with student loans. An attorney can advocate on your behalf, ensuring that your rights are protected and that you are treated fairly by lenders. They can also provide clarity on complex legal terms and help you avoid common pitfalls that could lead to further financial strain.

### Conclusion

If you are struggling with student loan debt, seeking the assistance of an experienced attorney like Josh Cohen Attorney Student Loan can be a crucial step toward financial recovery. With his extensive knowledge and personalized approach, he can help you navigate the complexities of student loans, offering solutions that are tailored to your specific needs. Don’t let student debt control your life—reach out to Josh Cohen today and take the first step toward a brighter financial future.