Maximize Your Savings with Our Comprehensive 401k Loan Calculator

### DescriptionIn today’s financial landscape, understanding how to manage your retirement savings is crucial. One of the most valuable tools at your dispos……

### Description

In today’s financial landscape, understanding how to manage your retirement savings is crucial. One of the most valuable tools at your disposal is the 401k loan calculator. This powerful resource allows you to evaluate the implications of borrowing against your 401k retirement plan, helping you make informed decisions about your financial future.

A 401k loan can be a viable option for those in need of immediate cash, whether it’s for home repairs, education expenses, or unexpected medical bills. However, it’s essential to understand the benefits and potential pitfalls of taking a loan from your retirement savings. Using a 401k loan calculator can provide clarity and insight into how much you can borrow, what your repayment terms will look like, and how this loan may affect your long-term retirement goals.

### How Does a 401k Loan Work?

When you take a loan from your 401k, you’re essentially borrowing from yourself. The money you withdraw is not taxed at the time of the loan, and you won’t incur early withdrawal penalties, provided you repay the loan within the specified timeframe. Most plans allow you to borrow up to 50% of your vested balance, with a maximum limit of $50,000.

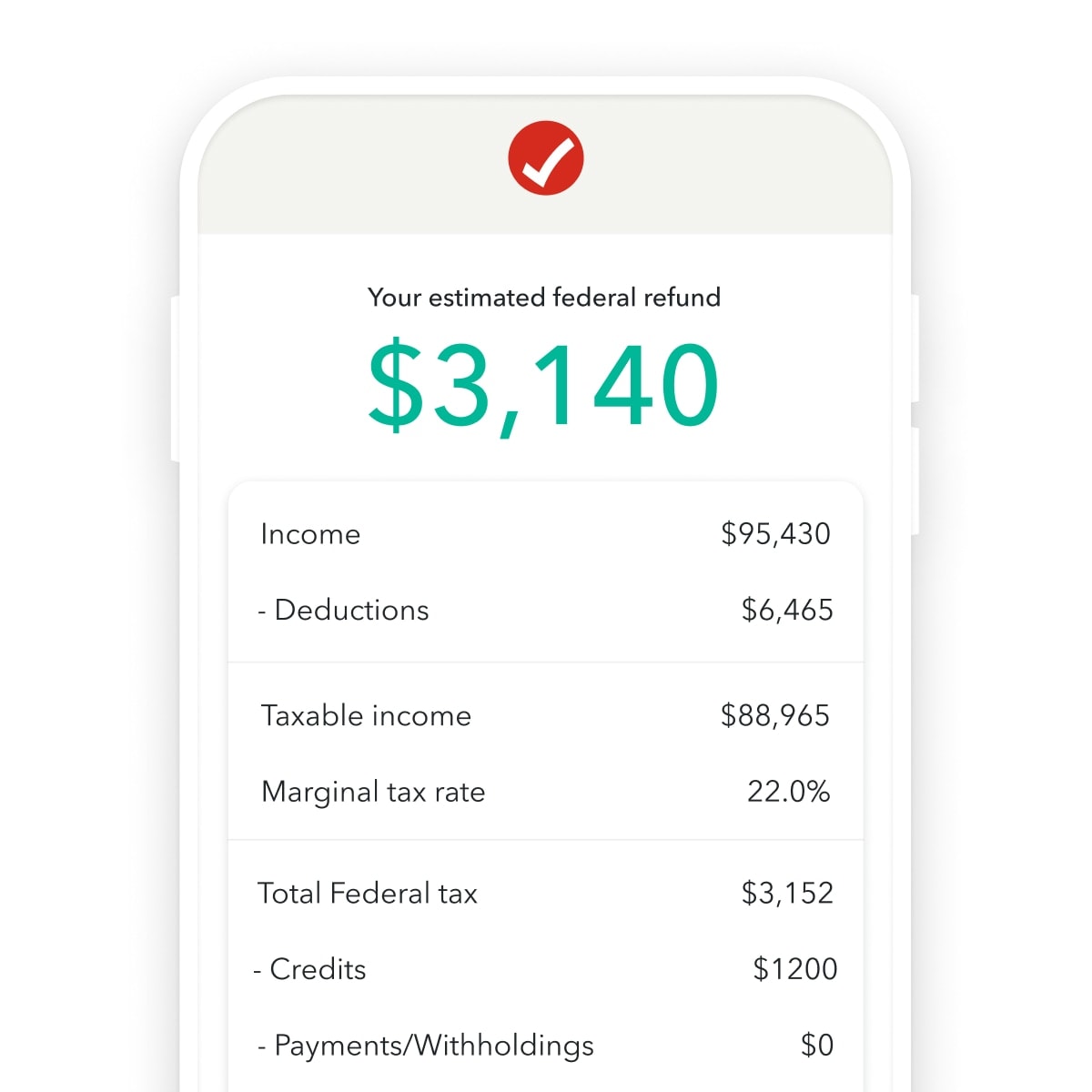

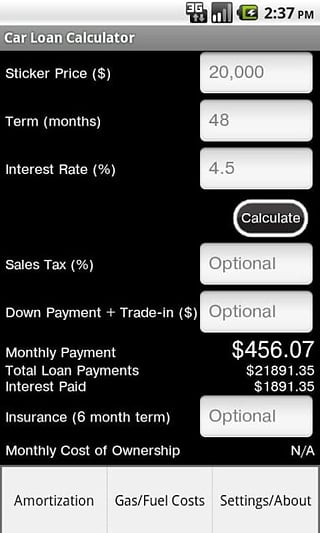

However, it’s important to remember that while you’re repaying the loan, you’re missing out on potential growth that your investments could have earned. This is where the 401k loan calculator comes into play. By inputting your current balance, the amount you wish to borrow, and the interest rate, you can see how much you will repay over time and what the impact on your retirement savings will be.

### Benefits of Using a 401k Loan Calculator

1. **Clarity on Loan Amounts**: The 401k loan calculator helps you determine how much you can borrow without jeopardizing your retirement savings. It takes the guesswork out of the equation, providing you with a clear figure based on your current 401k balance.

2. **Understanding Repayment Terms**: The calculator can also help you understand the repayment terms. Most loans must be repaid within five years, but if you’re using the funds to purchase a primary residence, you may have a longer repayment period. The calculator provides a breakdown of monthly payments and total interest paid over the life of the loan.

3. **Impact on Retirement Goals**: One of the most crucial aspects of borrowing from your 401k is understanding the long-term impact on your retirement savings. The 401k loan calculator allows you to visualize how the loan will affect your total retirement savings, helping you make a more informed decision.

### Potential Drawbacks of a 401k Loan

While there are benefits to taking a loan from your 401k, it’s not without its risks. If you leave your job or are terminated, the loan may become due in full, often within 60 days. Failure to repay could result in the loan being considered a distribution, leading to taxes and penalties.

Moreover, if you’re unable to make payments, you could significantly diminish your retirement savings. This is why utilizing a 401k loan calculator is vital before making any decisions. It can help you weigh the pros and cons effectively, ensuring that you’re making a sound financial choice.

### Conclusion

In conclusion, the 401k loan calculator is an invaluable tool for anyone considering borrowing from their retirement savings. By providing insights into loan amounts, repayment terms, and long-term impacts, it empowers you to make informed financial decisions. Always remember to assess your financial situation carefully and consider consulting with a financial advisor to explore all your options before proceeding with a 401k loan. Your retirement is one of your most significant financial goals, and ensuring you protect it should always be a top priority.