VA Home Loan Credit Score: A Comprehensive Guide to Securing Your Dream Home

Guide or Summary:VA Home Loan Credit Score: The BasicsUnderstanding the VA Home Loan Credit ScoreImproving Your VA Home Loan Credit ScoreWhen it comes to pu……

Guide or Summary:

- VA Home Loan Credit Score: The Basics

- Understanding the VA Home Loan Credit Score

- Improving Your VA Home Loan Credit Score

When it comes to purchasing a home, the process can be both exciting and daunting. For many veterans, the dream of homeownership is not just a personal aspiration but a testament to their service and sacrifice. Enter the VA home loan, a financial lifeline designed specifically for veterans, active-duty military members, and eligible surviving spouses. However, despite the benefits and advantages of this program, understanding the intricacies of the VA home loan credit score can be a hurdle for many.

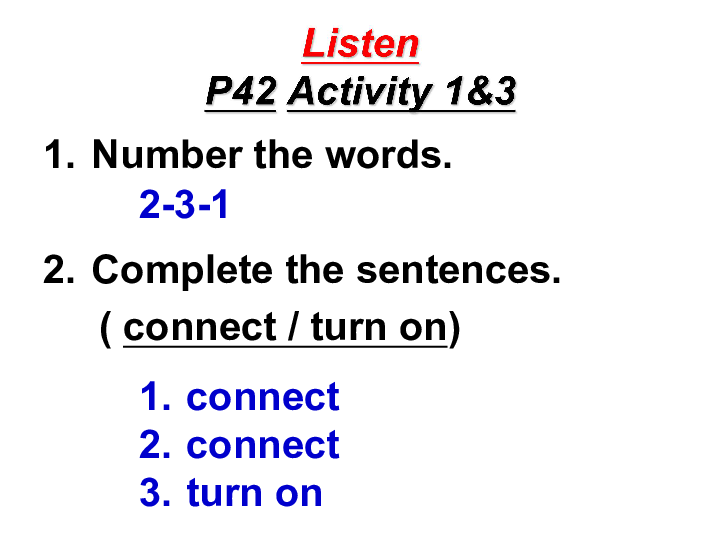

VA Home Loan Credit Score: The Basics

At its core, the VA home loan credit score is a crucial factor in determining your eligibility and the terms of your loan. Unlike conventional mortgages, which often require a credit score of 620 or higher, the VA home loan program offers more flexibility. While a good credit score is still beneficial, it is not the sole determinant of approval. This leniency is one of the many reasons why the VA home loan is often favored by veterans and active-duty military personnel.

Understanding the VA Home Loan Credit Score

The VA home loan credit score is derived from your credit report, which includes information about your credit history, payment behavior, outstanding debts, and overall credit utilization. While the exact formula used by the VA to calculate the credit score is not publicly disclosed, it generally takes into account a variety of factors that contribute to your overall creditworthiness.

One important aspect of the VA home loan credit score is the impact of delinquencies and defaults. These negative marks on your credit report can significantly lower your score and impact your ability to secure a loan. However, it's worth noting that the VA home loan program offers some leniency in this regard, allowing for a more holistic assessment of your financial situation.

Improving Your VA Home Loan Credit Score

If you're looking to improve your VA home loan credit score, there are several steps you can take. First and foremost, it's essential to monitor your credit report regularly to identify and dispute any inaccuracies. Paying your bills on time, reducing your credit card balances, and avoiding unnecessary credit inquiries can also help improve your score.

For those with a history of delinquencies or defaults, it may take some time and effort to rebuild your credit. However, the VA home loan program recognizes the unique challenges faced by veterans and active-duty military members, and as such, may offer more lenient terms for those who demonstrate a commitment to financial responsibility.

The VA home loan credit score is a critical component of the homebuying process for veterans and active-duty military members. While it may seem daunting at first, understanding the factors that influence your score and taking proactive steps to improve it can make all the difference in securing your dream home. With the right approach and a commitment to financial health, the VA home loan program can be a valuable resource for those looking to turn their homeownership dreams into reality.