"Maximize Your Student Loan Repayment Strategy: A Comprehensive Guide to Navigating Student Loans on April 30"

Guide or Summary:Student Loans - Understanding the Basics of Student Loan RepaymentStudent Loans - The Importance of Timely RepaymentStudent Loans - Strateg……

Guide or Summary:

- Student Loans - Understanding the Basics of Student Loan Repayment

- Student Loans - The Importance of Timely Repayment

- Student Loans - Strategies for Reducing Your Student Loan Debt

- Student Loans - The Benefits of Loan Forgiveness and Repayment Incentives

- Student Loans - Navigating the Complexities of Student Loan Repayment

- Student Loans - The Role of Technology in Student Loan Repayment

- Student Loans - Embracing a Positive Attitude Towards Student Loan Repayment

Student Loans - Understanding the Basics of Student Loan Repayment

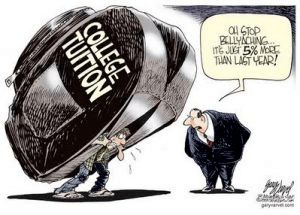

Student loans are a significant financial commitment for many Americans, especially those who are pursuing higher education. These loans can be a powerful tool for funding education and achieving career goals, but they also come with a set of complex rules and terms that can be difficult to navigate. As you prepare for your student loan repayment on April 30, it's essential to have a clear understanding of the basics of student loan repayment.

Student Loans - The Importance of Timely Repayment

Student loans are not only a financial burden but also a responsibility. Late payments can result in penalties, damage your credit score, and even cause your loans to be transferred to a collection agency. To avoid these negative consequences, it's crucial to make timely payments on your student loans. One effective way to ensure timely payments is to set up automatic payments through your loan servicer.

Student Loans - Strategies for Reducing Your Student Loan Debt

Student loans can be overwhelming, but there are several strategies you can use to reduce your student loan debt. One effective strategy is to pay more than the minimum payment each month. By doing so, you'll pay off your loans faster and save money on interest in the long run. Additionally, consider refinancing your student loans to secure a lower interest rate and reduce your monthly payments.

Student Loans - The Benefits of Loan Forgiveness and Repayment Incentives

If you're struggling to make your student loan payments, you may be eligible for loan forgiveness or repayment incentives. Loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF), can help eliminate your remaining student loan debt after you've made a certain number of qualifying payments. Repayment incentives, such as income-driven repayment plans, can also help reduce your monthly payments and make them more manageable.

Student Loans - Navigating the Complexities of Student Loan Repayment

Student loan repayment can be a complex process, especially if you're dealing with multiple loans or have questions about your repayment options. To navigate these complexities, it's essential to stay informed about the terms and conditions of your student loans. Additionally, consider speaking with a financial advisor or loan repayment counselor who can provide personalized advice and assistance.

Student Loans - The Role of Technology in Student Loan Repayment

In today's digital age, technology plays a significant role in student loan repayment. Many loan servicers offer online portals where you can view your account information, make payments, and manage your repayment options. Additionally, there are several apps and tools available that can help you track your student loan debt, manage your budget, and find repayment strategies that work for you.

Student Loans - Embracing a Positive Attitude Towards Student Loan Repayment

Student loan repayment can be a challenging process, but it's important to approach it with a positive attitude. By staying organized, staying informed, and staying committed to your repayment plan, you can make steady progress towards becoming debt-free. Remember, every payment you make towards your student loans is a step towards achieving your financial goals and securing your future.

In conclusion, navigating student loan repayment on April 30 can be a daunting task, but with the right strategies and resources, it's entirely possible. By understanding the basics of student loan repayment, utilizing effective repayment strategies, and staying informed about your options, you can make informed decisions and take control of your student loan debt. Remember, the journey to becoming debt-free is a marathon, not a sprint, so stay focused, stay positive, and stay committed to your goals.