Home Loan Approval Time: A Comprehensive Guide to Understanding the Process and How to Speed It Up

Guide or Summary:Home Loan Approval TimeHome Loan Approval Process OverviewFactors Influencing Home Loan Approval TimeStrategies for Speeding Up the Home Lo……

Guide or Summary:

- Home Loan Approval Time

- Home Loan Approval Process Overview

- Factors Influencing Home Loan Approval Time

- Strategies for Speeding Up the Home Loan Approval Process

Home Loan Approval Time

Homeownership is the quintessential American dream, and securing a home loan is often the first step toward achieving this aspiration. However, the process of obtaining a home loan can be complex and time-consuming, with various stages and requirements that must be met. Understanding the home loan approval time and the factors that can influence it is essential for anyone embarking on this journey. This comprehensive guide delves into the intricacies of the home loan approval process, offering insights into how to streamline it and expedite your journey to home ownership.

Home Loan Approval Process Overview

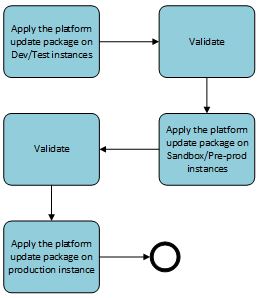

The home loan approval process typically involves several key steps:

1. **Pre-approval**: Before you start looking for a home, obtaining pre-approval from a lender is crucial. This step involves submitting financial information, including income, debts, and credit history, to a lender who will determine your eligibility for a mortgage and the amount you can borrow.

2. **Property Search**: With pre-approval in hand, you can begin your search for a home that fits your budget and requirements. This stage typically involves working with a real estate agent to find listings and schedule showings.

3. **Offer and Inspection**: Once you've found a home you love, you'll make an offer. If the seller accepts, you'll proceed with a home inspection to identify any potential issues with the property.

4. **Loan Application**: After the offer is accepted and the inspection is complete, you'll need to formally apply for the home loan. This involves gathering all necessary documentation and submitting it to the lender.

5. **Underwriting**: The lender will review your application and supporting documents to assess your creditworthiness and determine the loan amount. This stage can take several days to a few weeks, depending on the lender's workload and the complexity of your financial situation.

6. **Closing**: Once your loan is approved, you'll move forward with the closing process. This involves signing paperwork, paying closing costs, and finalizing the sale. The time frame for closing can vary, but it typically takes a few weeks.

Factors Influencing Home Loan Approval Time

Several factors can impact the time it takes to secure a home loan:

1. **Lender's Processing Speed**: The efficiency with which the lender processes your application can significantly impact the approval time. Some lenders are more streamlined than others, with faster processing times.

2. **Credit Score and Financial History**: Your credit score and financial history play a crucial role in determining your eligibility for a loan and the interest rate you'll receive. A higher credit score and a clean financial history can expedite the approval process.

3. **Documentation Completeness**: Providing all necessary documentation promptly and accurately is essential for a smooth application process. Incomplete or incorrect documents can delay approval.

4. **Property Complexity**: The complexity of the property itself can also affect the approval time. Properties with unique features, such as a historical home or a commercial space, may require additional scrutiny and processing time.

5. **Market Conditions**: The current state of the real estate market can also impact the approval time. In a seller's market, for example, where demand exceeds supply, lenders may be more cautious and thorough in their underwriting process.

Strategies for Speeding Up the Home Loan Approval Process

To minimize the time it takes to secure a home loan, consider the following strategies:

1. **Prepare Thoroughly**: Begin preparing your loan application well in advance. Gather all necessary documents, such as tax returns, bank statements, and employment records, and ensure they are up-to-date and accurate.

2. **Choose the Right Lender**: Research and compare lenders to find one with a reputation for fast processing times and favorable terms. Some online lenders, for example, are known for their quick approvals.

3. **Maintain a Strong Credit Score**: Regularly monitor your credit score and take steps to improve it, such as paying bills on time, keeping credit card balances low, and avoiding new credit applications.

4. **Streamline Your Application**: Provide all required documentation promptly and accurately to minimize delays. Consider using online tools and resources to streamline the application process.

5. **Plan Ahead for Closing**: Understand the closing process and plan accordingly. Have your finances in order, including funds for closing costs and any other fees, to ensure a smooth closing experience.

By understanding the home loan approval process and taking steps to streamline it, you can minimize delays and move closer to your dream of homeownership. With careful planning and preparation, you can significantly reduce the time it takes to secure a home loan and enjoy the peace of mind that comes with owning your own home.