Apply for Public Service Loan Forgiveness: A Comprehensive Guide for Eligible Borrowers

Guide or Summary:Eligibility Criteria for Public Service Loan ForgivenessQualifying Employers for Public Service Loan ForgivenessUnderstanding Qualifying Pa……

Guide or Summary:

- Eligibility Criteria for Public Service Loan Forgiveness

- Qualifying Employers for Public Service Loan Forgiveness

- Understanding Qualifying Payments for Public Service Loan Forgiveness

- Application Process for Public Service Loan Forgiveness

- Common Questions and Considerations for Public Service Loan Forgiveness

In an era where education is the cornerstone of personal and professional growth, the pursuit of higher learning often comes with a hefty price tag. For many, the prospect of repaying student loans can be daunting, especially when the financial burden seems insurmountable. Fortunately, the U.S. government has implemented a program designed to alleviate this burden for those who dedicate their careers to public service. This guide delves into the intricacies of applying for public service loan forgiveness (PSLF), ensuring that eligible borrowers understand the process and maximize their potential for loan forgiveness.

Eligibility Criteria for Public Service Loan Forgiveness

To be eligible for PSLF, borrowers must meet certain criteria. These include:

- Having federal Direct Loans

- Making 120 qualifying monthly payments while working full-time for a qualifying employer

- Serving in a qualifying public service position for a cumulative total of 120 qualifying payments

Qualifying Employers for Public Service Loan Forgiveness

Not all jobs in the public sector qualify for PSLF. To be considered a qualifying employer, the organization must be:

- A federal, state, local, or tribal government organization

- A not-for-profit organization that is tax-exempt under section 501(c)(3) of the Internal Revenue Code and provides a qualifying public service employment opportunity

- A private organization that is not-for-profit and provides a qualifying public service employment opportunity

Understanding Qualifying Payments for Public Service Loan Forgiveness

Qualifying payments for PSLF are those made while working for a qualifying employer in a qualifying public service position. These payments must be made under a repayment plan that allows for periodic payments, such as Income-Driven Repayment (IDR) plans, or under the standard repayment plan. Borrowers should ensure that they are making qualifying payments to maximize their chances of loan forgiveness.

Application Process for Public Service Loan Forgiveness

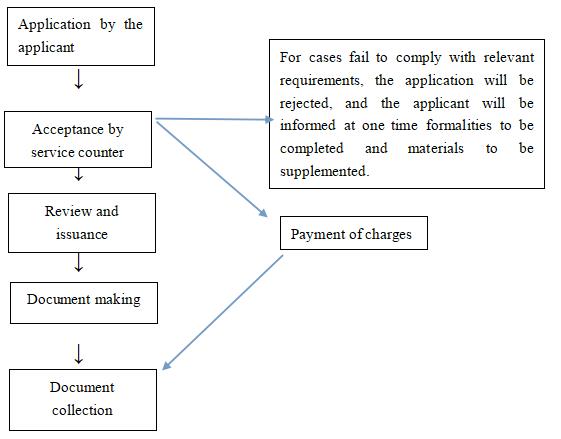

The application for PSLF can be submitted online through the Federal Student Aid website. Borrowers will need to provide information about their federal Direct Loans, their qualifying employment, and their qualifying payments. It is important to note that borrowers must submit a new application each year to continue to qualify for PSLF.

Common Questions and Considerations for Public Service Loan Forgiveness

- Can I apply for PSLF if I have private student loans?

No, PSLF is only available for federal Direct Loans.

- How can I ensure that my payments are qualifying?

Make sure you are working for a qualifying employer and making payments under a repayment plan that allows for periodic payments.

- What happens if I change jobs or leave my qualifying employer?

If you change jobs or leave your qualifying employer, you must notify the Department of Education within 30 days to avoid a break in your qualifying period.

In conclusion, the Public Service Loan Forgiveness program offers a lifeline to borrowers who choose to dedicate their careers to public service. By understanding the eligibility criteria, qualifying employers, and the application process, eligible borrowers can take advantage of this valuable program and work towards a debt-free future. Whether you are just starting your career in the public sector or are considering a change in direction, PSLF is a valuable tool that can help you achieve your goals while making a meaningful impact in your community.