"Unlock Your Financial Freedom with Installment Loans in Baton Rouge: A Comprehensive Guide"

#### What Are Installment Loans in Baton Rouge?Installment loans in Baton Rouge are a type of financing that allows borrowers to receive a lump sum of money……

#### What Are Installment Loans in Baton Rouge?

Installment loans in Baton Rouge are a type of financing that allows borrowers to receive a lump sum of money upfront, which they then repay over a set period through scheduled payments, or installments. These loans are typically used for various purposes, including consolidating debt, funding large purchases, or covering unexpected expenses. The structure of installment loans makes them an attractive option for many residents of Baton Rouge seeking financial assistance.

#### Benefits of Installment Loans in Baton Rouge

One of the primary benefits of installment loans in Baton Rouge is the predictability they offer. Borrowers know exactly how much they need to pay each month, making budgeting easier. Additionally, these loans often come with fixed interest rates, which means that the cost of borrowing remains stable throughout the loan term. This stability can be particularly beneficial for individuals who may struggle with fluctuating expenses.

#### Who Qualifies for Installment Loans in Baton Rouge?

Qualifying for installment loans in Baton Rouge typically depends on several factors, including credit score, income level, and existing debt obligations. While traditional lenders may have stricter requirements, many alternative lenders are more flexible, allowing individuals with less-than-perfect credit to secure financing. It's essential for potential borrowers to assess their financial situation and shop around for lenders that offer favorable terms.

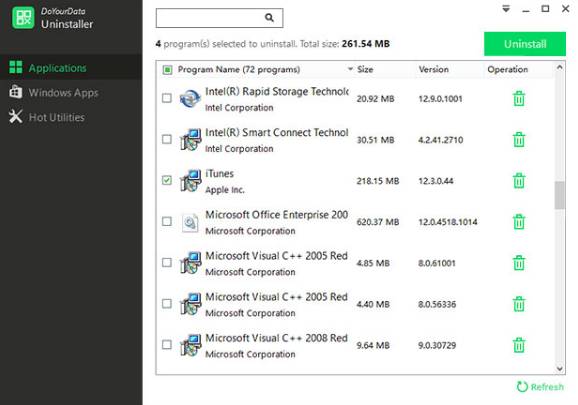

#### How to Apply for Installment Loans in Baton Rouge

Applying for installment loans in Baton Rouge is a straightforward process. Most lenders provide online applications, making it convenient for borrowers to submit their information from the comfort of their homes. The application usually requires personal details, employment information, and financial history. Once submitted, lenders will review the application and determine eligibility, often providing a decision within a short time frame.

#### Repayment Terms for Installment Loans in Baton Rouge

Repayment terms for installment loans in Baton Rouge can vary widely depending on the lender and the amount borrowed. Generally, these loans can range from a few months to several years. Borrowers should carefully review the terms and conditions before signing any agreement, ensuring they understand the total cost of the loan, including interest rates and any potential fees.

#### Finding the Right Lender for Installment Loans in Baton Rouge

With numerous lenders offering installment loans in Baton Rouge, it's crucial for borrowers to conduct thorough research. Comparing interest rates, repayment terms, and customer reviews can help individuals find a lender that aligns with their financial needs. Additionally, seeking recommendations from friends or family members can provide valuable insights into reputable lending institutions in the area.

#### Conclusion: Making Informed Financial Decisions

In conclusion, installment loans in Baton Rouge can be a viable solution for individuals seeking financial assistance. By understanding the benefits, qualification criteria, application process, and repayment terms, borrowers can make informed decisions that align with their financial goals. Whether it's for consolidating debt or covering unexpected expenses, these loans provide an opportunity for residents of Baton Rouge to regain control over their finances and work towards a more secure financial future. Always remember to borrow responsibly and ensure that any loan taken aligns with your ability to repay.