"How to Secure Personal Loans for Weddings: A Comprehensive Guide to Financing Your Dream Day"

#### Understanding Personal Loans for WeddingsPersonal loans for weddings are a popular financing option for couples looking to fund their special day witho……

#### Understanding Personal Loans for Weddings

Personal loans for weddings are a popular financing option for couples looking to fund their special day without breaking the bank. These loans allow you to borrow a specific amount of money that can be used to cover various wedding expenses, such as venue rentals, catering, photography, and more. Unlike traditional wedding loans, personal loans can be used for any wedding-related expense, providing flexibility in how you allocate your budget.

#### Why Consider Personal Loans for Weddings?

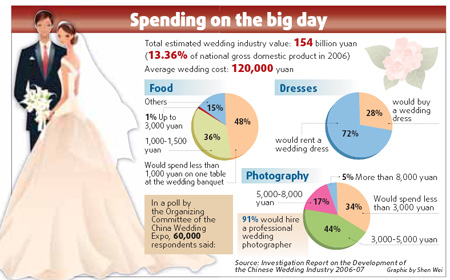

There are several reasons why couples might consider personal loans for weddings. First and foremost, weddings can be incredibly expensive, with the average cost reaching into the tens of thousands of dollars. Many couples may not have the savings necessary to cover all their expenses upfront. Personal loans for weddings offer a viable solution, allowing couples to finance their dream wedding while paying off the loan over time.

Additionally, personal loans often come with lower interest rates compared to credit cards, making them a more affordable option for borrowing money. This can help couples manage their finances better and avoid accumulating high-interest debt.

#### How to Apply for Personal Loans for Weddings

Applying for personal loans for weddings is a straightforward process, but it requires careful planning and consideration. Here’s a step-by-step guide to help you navigate the application process:

1. **Assess Your Budget**: Before applying for a loan, determine how much you need to borrow. Create a detailed budget that outlines all your wedding expenses to avoid borrowing more than necessary.

2. **Check Your Credit Score**: Your credit score will significantly impact your loan eligibility and interest rate. Obtain a copy of your credit report and address any discrepancies that may affect your score.

3. **Research Lenders**: Not all lenders offer the same terms and rates. Shop around and compare different lenders to find the best personal loans for weddings. Look for lenders that specialize in personal loans and have positive customer reviews.

4. **Gather Documentation**: When applying for a loan, you’ll need to provide documentation such as proof of income, employment verification, and identification. Be prepared to submit these documents to expedite the approval process.

5. **Submit Your Application**: Once you’ve chosen a lender, fill out the loan application. Be honest and thorough in your application to avoid delays in processing.

6. **Review Loan Terms**: If approved, carefully review the loan terms, including interest rates, repayment schedules, and any fees associated with the loan. Ensure that you fully understand your obligations before accepting the loan.

7. **Receive Funds**: After accepting the loan, the funds will typically be disbursed to your bank account, allowing you to start paying for your wedding expenses.

#### Tips for Managing Personal Loans for Weddings

Once you’ve secured personal loans for weddings, it’s essential to manage your debt responsibly. Here are some tips to help you stay on track:

- **Create a Repayment Plan**: Outline a repayment plan that fits your budget. Make sure to include monthly payments in your financial planning to avoid late fees.

- **Avoid Additional Debt**: While planning your wedding, resist the temptation to take on additional debt. Stick to your budget and prioritize your expenses.

- **Communicate with Your Partner**: Discuss financial matters openly with your partner to ensure you’re both on the same page regarding spending and repayment.

- **Consider Alternatives**: If personal loans for weddings seem overwhelming, consider alternative financing options, such as saving over time, seeking financial help from family, or scaling back on certain expenses.

#### Conclusion

Personal loans for weddings can be a helpful tool for couples looking to finance their dream wedding. By understanding the process, researching lenders, and managing your repayments wisely, you can enjoy your special day without the burden of overwhelming debt. Remember to plan carefully, communicate openly with your partner, and make informed financial decisions to ensure a beautiful and memorable wedding experience.