"Maximize Your Financial Planning with the Ultimate Monthly Loan Calculator"

Guide or Summary:Monthly Loan CalculatorWhat is a Monthly Loan Calculator?How Does a Monthly Loan Calculator Work?Benefits of Using a Monthly Loan Calculato……

Guide or Summary:

- Monthly Loan Calculator

- What is a Monthly Loan Calculator?

- How Does a Monthly Loan Calculator Work?

- Benefits of Using a Monthly Loan Calculator

- Common Mistakes to Avoid

---

Monthly Loan Calculator

In today's fast-paced financial landscape, understanding your loan obligations is critical. A monthly loan calculator serves as an essential tool for individuals and businesses alike, allowing them to plan their finances more effectively. Whether you are considering a mortgage, personal loan, or auto financing, a monthly loan calculator can provide you with the insights you need to make informed decisions.

What is a Monthly Loan Calculator?

A monthly loan calculator is a user-friendly online tool designed to help borrowers estimate their monthly loan payments based on the loan amount, interest rate, and loan term. By inputting these variables, users can quickly determine how much they will need to pay each month, making it easier to budget and manage their finances.

How Does a Monthly Loan Calculator Work?

To use a monthly loan calculator, you typically need to input several key pieces of information:

1. **Loan Amount**: The total amount you wish to borrow.

2. **Interest Rate**: The annual interest rate charged by the lender.

3. **Loan Term**: The duration over which you will repay the loan, usually expressed in years.

Once you input these details, the calculator uses a standard formula to compute your estimated monthly payment. This calculation often includes principal and interest, and some calculators may also allow you to factor in additional costs such as property taxes and insurance for mortgages.

Benefits of Using a Monthly Loan Calculator

1. **Budgeting**: Knowing your monthly payment can help you budget more effectively. You can assess whether you can comfortably afford the loan without compromising your other financial obligations.

2. **Comparison Shopping**: A monthly loan calculator allows you to compare different loan options. By adjusting the interest rates and terms, you can see how they impact your monthly payments, helping you make the best choice.

3. **Financial Planning**: Whether you are saving for a home or planning for a new car, understanding your potential payments can aid in your financial planning. It sets clear expectations about your future financial commitments.

4. **Simplicity**: Most monthly loan calculators are straightforward and easy to use. You don’t need to be a financial expert to understand how they work, making them accessible to everyone.

Common Mistakes to Avoid

While a monthly loan calculator is a valuable tool, there are common pitfalls to be aware of:

1. **Ignoring Additional Costs**: Remember that the monthly payment calculated does not always include other expenses such as insurance, taxes, or maintenance costs, especially in the case of mortgages.

2. **Assuming Fixed Rates**: If you are considering an adjustable-rate loan, remember that your payments may change over time, which the calculator might not reflect.

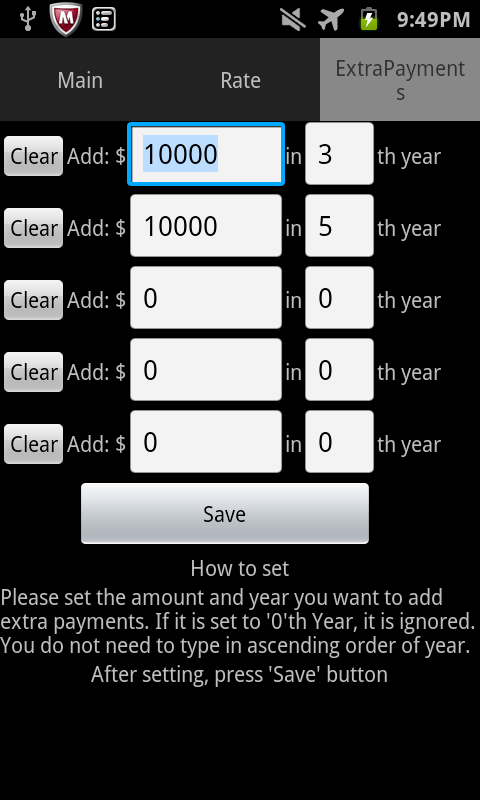

3. **Not Considering Prepayment Options**: Some loans allow you to make additional payments toward the principal. Using a monthly loan calculator to see how extra payments affect your loan can save you money in interest over time.

In conclusion, a monthly loan calculator is an indispensable tool for anyone looking to manage their loans more effectively. By providing a clear picture of what your monthly payments will be, it empowers you to make informed financial decisions. Whether you're planning to take out a new loan or refinance an existing one, leveraging this tool can enhance your financial literacy and help you achieve your financial goals. So, take advantage of a monthly loan calculator today and take the first step towards smarter financial planning!