Understanding Unsecured Loan Interest Rates: What You Need to Know Before Borrowing

Guide or Summary:Unsecured Loan Interest RateWhat is an Unsecured Loan?Factors Influencing Unsecured Loan Interest RatesHow to Find the Best Unsecured Loan……

Guide or Summary:

- Unsecured Loan Interest Rate

- What is an Unsecured Loan?

- Factors Influencing Unsecured Loan Interest Rates

- How to Find the Best Unsecured Loan Interest Rates

Unsecured Loan Interest Rate

Unsecured loans have become increasingly popular among borrowers seeking quick access to funds without the need for collateral. However, one of the most critical aspects of these loans is the interest rate associated with them. The unsecured loan interest rate plays a significant role in determining the overall cost of borrowing and can vary widely based on several factors. In this article, we will explore what an unsecured loan is, how interest rates are determined, and what borrowers should consider when looking for the best rates.

What is an Unsecured Loan?

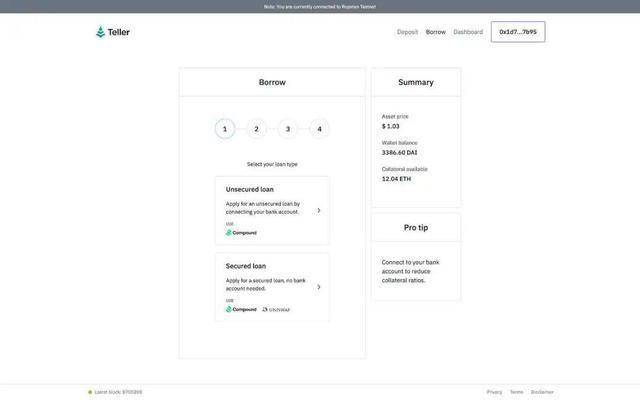

An unsecured loan is a type of borrowing that does not require the borrower to provide any collateral, such as a house or car. This means that if the borrower defaults on the loan, the lender cannot claim any specific asset to recover their losses. Because of this increased risk, lenders typically charge higher interest rates on unsecured loans compared to secured loans. Common types of unsecured loans include personal loans, credit cards, and student loans.

Factors Influencing Unsecured Loan Interest Rates

The unsecured loan interest rate is influenced by several factors, including:

1. **Credit Score**: One of the most significant determinants of the interest rate is the borrower's credit score. A higher credit score indicates to lenders that the borrower is less risky, which can lead to lower interest rates. Conversely, a lower credit score may result in higher rates.

2. **Loan Amount and Term**: The amount borrowed and the repayment term can also affect the interest rate. Generally, larger loans or longer repayment terms may come with different rates. Lenders assess the risk associated with the loan amount and duration before determining the interest rate.

3. **Market Conditions**: Economic factors, such as inflation and the central bank's interest rate policies, can impact unsecured loan interest rates. When the economy is strong, interest rates may rise; during economic downturns, they may decrease.

4. **Lender Policies**: Different lenders have varying criteria and policies for setting interest rates. It is essential for borrowers to shop around and compare offers from multiple lenders to find the most favorable rate.

How to Find the Best Unsecured Loan Interest Rates

To secure the best unsecured loan interest rate, borrowers should consider the following steps:

1. **Check Your Credit Score**: Before applying for a loan, check your credit score to understand where you stand. If your score is low, consider taking steps to improve it before applying for a loan.

2. **Compare Lenders**: Research various lenders to compare their interest rates, fees, and loan terms. Online platforms can make this process easier by providing side-by-side comparisons.

3. **Consider Prequalification**: Many lenders offer prequalification, which allows you to see potential rates without impacting your credit score. This can help you gauge what rates you might qualify for.

4. **Negotiate**: Don’t hesitate to negotiate with lenders. If you have received better offers from other institutions, bring this information to your preferred lender to see if they can match or beat the rate.

5. **Read the Fine Print**: Always read the loan agreement carefully before signing. Look for any hidden fees or conditions that could affect the total cost of the loan.

Understanding the unsecured loan interest rate is crucial for anyone considering borrowing. By taking the time to research and compare options, borrowers can make informed decisions that align with their financial goals. Whether you are looking for a personal loan to cover unexpected expenses or to consolidate debt, being aware of the factors that influence interest rates can help you secure the best deal possible.