Understanding FHA Loan Insurance: A Complete Guide to Benefits, Costs, and Eligibility

#### What is FHA Loan Insurance?FHA loan insurance is a type of mortgage insurance that is required for loans backed by the Federal Housing Administration……

#### What is FHA Loan Insurance?

FHA loan insurance is a type of mortgage insurance that is required for loans backed by the Federal Housing Administration (FHA). This insurance protects lenders in case the borrower defaults on the loan. It plays a crucial role in making homeownership accessible to a wider range of individuals, particularly first-time homebuyers or those with less-than-perfect credit.

#### Benefits of FHA Loan Insurance

One of the primary benefits of FHA loan insurance is that it allows borrowers to qualify for a mortgage with a lower down payment, often as low as 3.5%. This is particularly advantageous for first-time homebuyers who may not have substantial savings. Additionally, FHA loans are generally easier to qualify for compared to conventional loans, making them an attractive option for individuals with lower credit scores.

Another significant benefit is the flexibility in debt-to-income ratios. FHA guidelines allow for higher ratios, which means that borrowers can have a larger portion of their income dedicated to housing costs without being disqualified. This flexibility can be crucial for those who have student loans or other debts but still wish to purchase a home.

#### Costs Associated with FHA Loan Insurance

While FHA loan insurance provides many benefits, it does come with associated costs. Borrowers are required to pay an upfront mortgage insurance premium (UFMIP) at the time of closing, which is typically 1.75% of the loan amount. Additionally, there are ongoing monthly premiums that must be paid as part of the mortgage payment. These costs can add up, so it’s essential for potential borrowers to factor them into their overall budget when considering an FHA loan.

#### Eligibility Requirements for FHA Loan Insurance

To qualify for FHA loan insurance, borrowers must meet certain eligibility criteria. Firstly, the borrower must have a valid Social Security number and be a legal resident of the United States. Additionally, the borrower’s credit score must typically be at least 580 to qualify for the 3.5% down payment option, though those with lower scores may still qualify with a higher down payment.

Another requirement is that the property being purchased must be the borrower’s primary residence. FHA loans cannot be used for investment properties or vacation homes. Furthermore, the property must meet certain safety and livability standards, as determined by an FHA appraisal.

#### How to Apply for FHA Loan Insurance

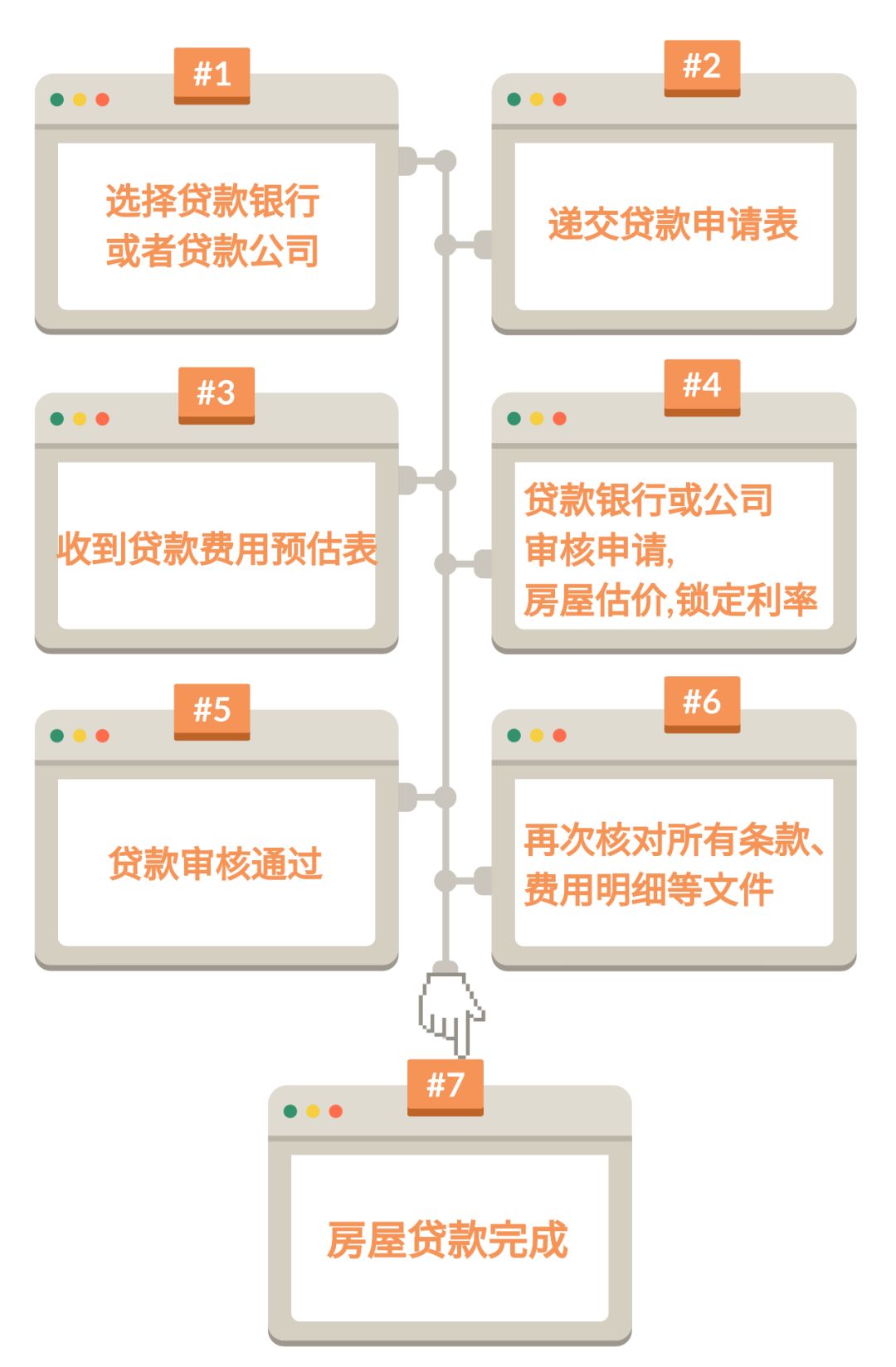

Applying for FHA loan insurance involves several steps. First, potential borrowers should find an FHA-approved lender. It’s important to shop around and compare rates and terms from different lenders to ensure the best deal. Once a lender has been chosen, the borrower will need to complete a mortgage application and provide documentation regarding their income, assets, and credit history.

After the application is submitted, the lender will conduct a thorough review, which includes a credit check and an assessment of the borrower’s financial situation. If approved, the lender will issue a loan estimate that outlines the terms of the mortgage, including the costs associated with FHA loan insurance.

#### Conclusion

FHA loan insurance is a vital component of the home-buying process for many Americans, particularly those who may struggle to secure financing through conventional means. By understanding the benefits, costs, and eligibility requirements associated with FHA loan insurance, potential homebuyers can make informed decisions and take significant steps toward homeownership. Whether you’re a first-time buyer or someone looking to refinance, FHA loan insurance offers a pathway to achieving your homeownership dreams.