Understanding Home Equity Loan Credit: Unlocking the Value of Your Property for Financial Freedom

**Home Equity Loan Credit** (房屋净值贷款信用)In today’s financial landscape, homeowners are increasingly looking to leverage their properties to access funds for v……

**Home Equity Loan Credit** (房屋净值贷款信用)

In today’s financial landscape, homeowners are increasingly looking to leverage their properties to access funds for various needs. One of the most popular ways to do this is through a **home equity loan credit**. This financial product allows homeowners to borrow against the equity they have built in their properties, providing them with a significant source of capital for home improvements, debt consolidation, or even funding major life events like education or weddings.

#### What is Home Equity Loan Credit?

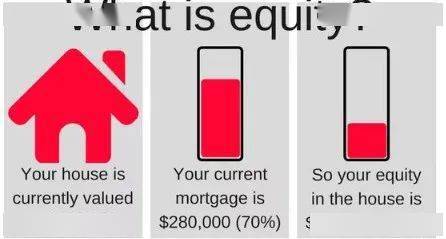

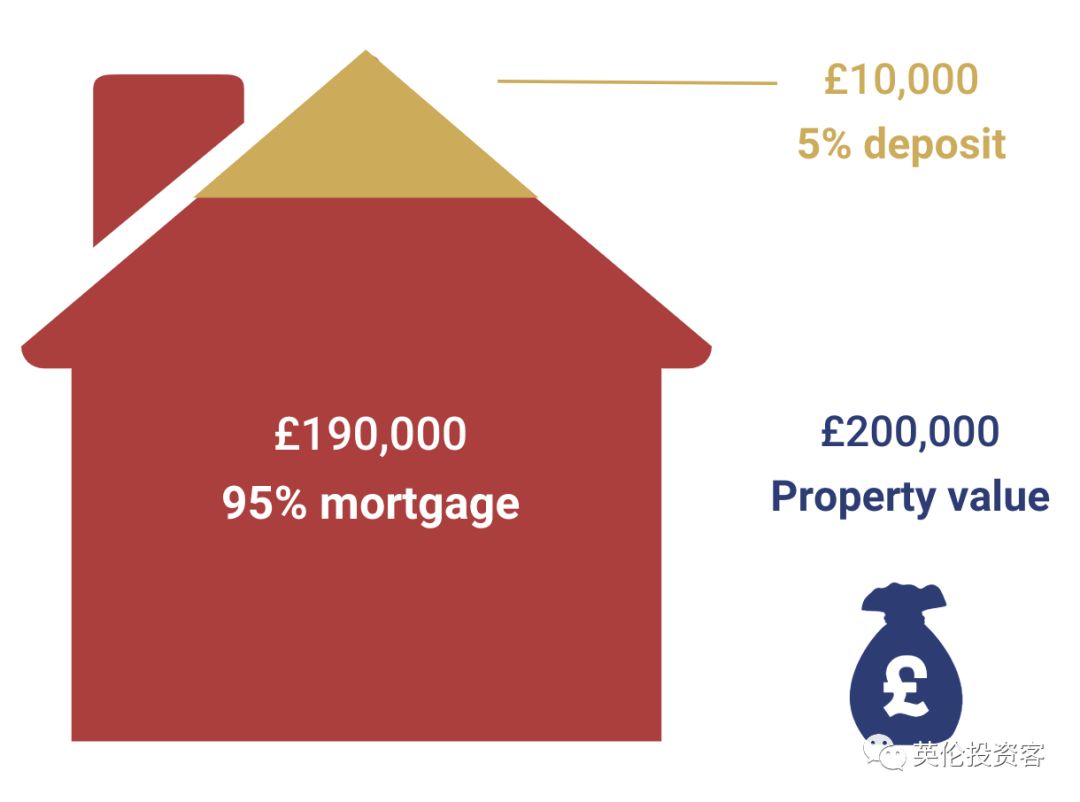

A **home equity loan credit** is a type of loan that allows you to borrow money by using your home as collateral. The amount you can borrow is typically based on the equity you have in your home, which is calculated by subtracting your mortgage balance from your home’s current market value. For instance, if your home is valued at $300,000 and you owe $200,000 on your mortgage, you have $100,000 in equity. Lenders usually allow you to borrow a percentage of that equity, often up to 80-90%.

#### Benefits of Home Equity Loan Credit

1. **Lower Interest Rates**: Compared to unsecured loans or credit cards, home equity loans typically offer lower interest rates because they are secured by your property. This can make borrowing more affordable.

2. **Tax Benefits**: In some cases, the interest paid on a home equity loan may be tax-deductible, particularly if the funds are used for home improvements. However, it’s essential to consult with a tax professional to understand your specific situation.

3. **Fixed Payments**: Many home equity loans come with fixed interest rates, which means your monthly payments will remain consistent throughout the life of the loan. This predictability can help with budgeting.

4. **Large Loan Amounts**: Since these loans are based on your home’s equity, you can often borrow larger sums of money than you could with personal loans or credit cards.

#### Considerations Before Applying for Home Equity Loan Credit

While there are many advantages to a **home equity loan credit**, there are also important factors to consider:

1. **Risk of Foreclosure**: Since your home is collateral for the loan, failing to make payments can result in foreclosure. It’s crucial to ensure that you can afford the monthly payments before taking out a loan.

2. **Closing Costs**: Home equity loans may come with closing costs and fees, which can add to the overall expense of borrowing.

3. **Market Fluctuations**: The value of your home can fluctuate due to market conditions. If property values decrease, you could owe more than your home is worth, which is known as being "underwater."

4. **Debt-to-Income Ratio**: Lenders will assess your debt-to-income ratio when considering your application. If you already have significant debt, it may impact your ability to qualify for a home equity loan.

#### How to Apply for Home Equity Loan Credit

If you decide that a **home equity loan credit** is right for you, the application process typically involves the following steps:

1. **Evaluate Your Equity**: Determine how much equity you have in your home. This will give you a clear idea of how much you can potentially borrow.

2. **Shop Around**: Different lenders offer varying terms, interest rates, and fees. It’s wise to compare offers to find the best deal.

3. **Prepare Documentation**: Lenders will require documentation such as proof of income, credit history, and information about your property.

4. **Apply**: Once you’ve chosen a lender, you can submit your application. The lender will then assess your financial situation and the value of your home.

5. **Close the Loan**: If approved, you’ll go through a closing process where you’ll sign the necessary paperwork and pay any closing costs.

In conclusion, a **home equity loan credit** can be a powerful financial tool for homeowners looking to access funds. By understanding how it works and weighing the pros and cons, you can make an informed decision that aligns with your financial goals. Always consult with financial advisors or mortgage professionals to ensure you’re making the best choice for your unique situation.