Ultimate Guide to Using a Principal Loan Calculator for Smart Financial Decisions

Guide or Summary:What is a Principal Loan Calculator?How Does a Principal Loan Calculator Work?Benefits of Using a Principal Loan CalculatorWhen it comes to……

Guide or Summary:

- What is a Principal Loan Calculator?

- How Does a Principal Loan Calculator Work?

- Benefits of Using a Principal Loan Calculator

When it comes to managing your finances, understanding how loans work is crucial. One of the most effective tools at your disposal is the principal loan calculator. This handy tool allows you to calculate the principal amount of a loan, helping you make informed decisions about borrowing and repayment. In this guide, we'll explore what a principal loan calculator is, how to use it, and the benefits it provides.

What is a Principal Loan Calculator?

A principal loan calculator is an online tool designed to help borrowers determine the principal amount of a loan based on various parameters such as interest rate, loan term, and monthly payments. It simplifies the complex calculations involved in loan management, making it accessible for anyone, regardless of their financial expertise.

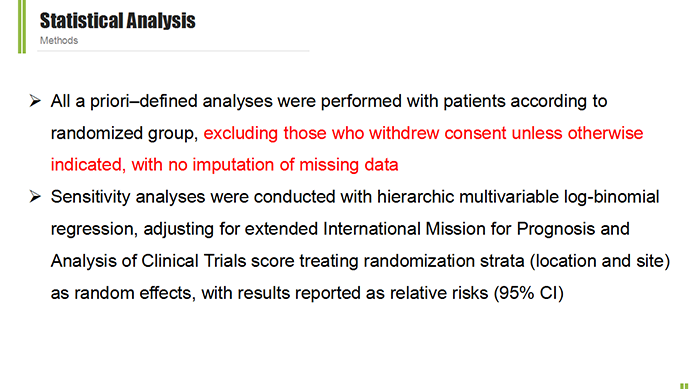

How Does a Principal Loan Calculator Work?

Using a principal loan calculator is straightforward. Typically, you will need to input the following information:

1. **Loan Amount**: This is the total amount of money you wish to borrow.

2. **Interest Rate**: The annual interest rate that will be applied to your loan.

3. **Loan Term**: The duration over which you plan to repay the loan, usually expressed in years.

4. **Monthly Payment**: The amount you can afford to pay each month.

Once you enter this information, the calculator will provide you with the principal amount, total interest paid over the life of the loan, and the total repayment amount. Some calculators may also break down your payments into principal and interest components, giving you a clearer picture of your financial obligations.

Benefits of Using a Principal Loan Calculator

1. **Informed Decision-Making**: A principal loan calculator empowers you to make informed decisions about your loan options. By adjusting the variables, you can see how changes in interest rates or loan terms affect your monthly payments and total interest costs.

2. **Budgeting Assistance**: Knowing your monthly payment helps you budget effectively. You can determine if a loan fits within your financial plan or if you need to reconsider your borrowing options.

3. **Comparison Tool**: If you're considering multiple loan offers, a principal loan calculator can help you compare them side by side. By entering different interest rates and terms, you can quickly identify the most cost-effective option.

4. **Prepayment Planning**: If you plan to make extra payments towards your loan, a calculator can show you how these payments will affect your principal balance and overall interest paid, helping you save money in the long run.

5. **Financial Literacy**: Using a principal loan calculator enhances your understanding of loan mechanics. This knowledge is invaluable when negotiating loan terms with lenders or assessing your financial health.

In conclusion, a principal loan calculator is an essential tool for anyone looking to navigate the complexities of borrowing. By providing clear insights into loan amounts, interest rates, and repayment schedules, it enables you to make smarter financial choices. Whether you're a first-time borrower or a seasoned investor, leveraging this calculator can lead to significant savings and a better understanding of your financial landscape. So, before you take on a new loan, make sure to utilize a principal loan calculator to ensure you're making the best decision for your financial future.