Understanding Loans for People on SSI Disability: Your Comprehensive Guide to Financial Support

#### IntroductionFor many individuals receiving Supplemental Security Income (SSI) disability benefits, financial challenges can be a significant concern. F……

#### Introduction

For many individuals receiving Supplemental Security Income (SSI) disability benefits, financial challenges can be a significant concern. Fortunately, there are options available, including **loans for people on SSI disability**. This article aims to provide a thorough understanding of these loans, their eligibility criteria, and how to navigate the application process effectively.

#### What Are Loans for People on SSI Disability?

**Loans for people on SSI disability** are financial products specifically designed to assist those who receive SSI benefits. These loans can help cover various expenses, from medical bills to everyday living costs. It's essential to understand that while obtaining loans might be challenging for individuals on disability, various lenders recognize the need for financial support and offer tailored solutions.

#### Eligibility Criteria

To qualify for **loans for people on SSI disability**, applicants typically need to meet certain criteria:

1. **Proof of SSI Benefits**: Lenders will require documentation showing that you receive SSI benefits. This proof demonstrates your income level and helps the lender assess your ability to repay the loan.

2. **Credit History**: While some lenders may be more lenient regarding credit scores, having a decent credit history can improve your chances of obtaining a loan. It's advisable to check your credit report for any discrepancies and work on improving your score if necessary.

3. **Income Verification**: In addition to SSI benefits, lenders may ask for additional income sources, such as part-time work or other benefits. This information helps them evaluate your overall financial situation.

#### Types of Loans Available

There are various types of **loans for people on SSI disability**, including:

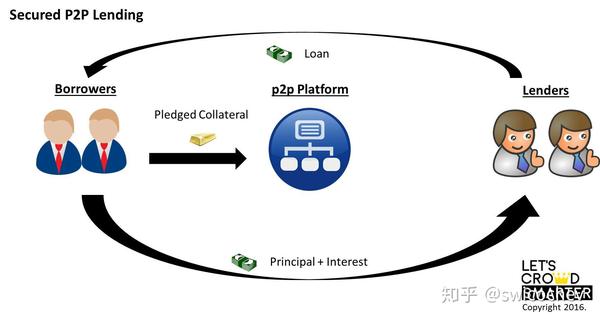

1. **Personal Loans**: These are unsecured loans that do not require collateral. They can be used for any purpose, making them a flexible option for those in need.

2. **Payday Loans**: Although these loans are easy to obtain, they often come with high-interest rates. It's crucial to understand the terms and conditions before proceeding with this option.

3. **Title Loans**: If you own a vehicle, you may consider a title loan, which uses your car as collateral. This option can provide quick cash but carries the risk of losing your vehicle if you default on the loan.

4. **Credit Union Loans**: Many credit unions offer loans specifically for individuals on disability. These loans often come with lower interest rates and more favorable terms compared to traditional lenders.

#### How to Apply for Loans

Applying for **loans for people on SSI disability** involves several steps:

1. **Research Lenders**: Start by researching lenders who specialize in loans for individuals on disability. Look for reviews and testimonials to gauge their reputation.

2. **Gather Documentation**: Prepare all necessary documents, including proof of SSI benefits, identification, and any other financial information required by the lender.

3. **Complete the Application**: Fill out the loan application accurately and thoroughly. Providing complete information can expedite the approval process.

4. **Review Loan Terms**: Before accepting a loan, carefully review the terms and conditions, including interest rates, repayment schedules, and any fees involved.

5. **Receive Funds**: Once approved, the lender will disburse the funds, which you can use to address your financial needs.

#### Conclusion

Navigating financial challenges while on SSI disability can be daunting, but understanding **loans for people on SSI disability** can provide the support you need. By exploring your options, meeting eligibility criteria, and following the application process, you can secure the financial assistance necessary to improve your quality of life. Remember to conduct thorough research and choose a loan that aligns with your financial capabilities to ensure a manageable repayment plan.