Maximize Your Retirement Savings: How to Use the 401k Loan Calculator Bi Weekly Payments for Smart Financial Planning

When it comes to financial planning for your future, understanding how to effectively manage your retirement savings is crucial. One tool that can significa……

When it comes to financial planning for your future, understanding how to effectively manage your retirement savings is crucial. One tool that can significantly aid in this process is the 401k Loan Calculator Bi Weekly Payments. This calculator helps you determine how much you can borrow from your 401k plan and how your bi-weekly payments will affect your overall retirement savings. In this article, we will explore the benefits of using a 401k loan calculator, how bi-weekly payments work, and tips for making informed decisions about your 401k loans.

#### Understanding the 401k Loan Calculator Bi Weekly Payments

The 401k Loan Calculator Bi Weekly Payments is designed to help you assess the impact of taking a loan from your 401k retirement savings plan. When you borrow from your 401k, you are essentially taking a loan against your own savings, which you are required to pay back with interest. The calculator allows you to input various parameters, such as the loan amount, interest rate, and repayment period, to estimate your bi-weekly payment amounts.

#### Benefits of Using the 401k Loan Calculator Bi Weekly Payments

1. **Clarity on Loan Terms**: By using the 401k Loan Calculator Bi Weekly Payments, you can gain a clear understanding of how much you will need to pay back each pay period. This clarity can help you budget more effectively and avoid financial strain.

2. **Interest Considerations**: The calculator also allows you to see how much interest you will pay over the life of the loan. Understanding this can help you make more informed decisions about whether to take the loan or explore other financing options.

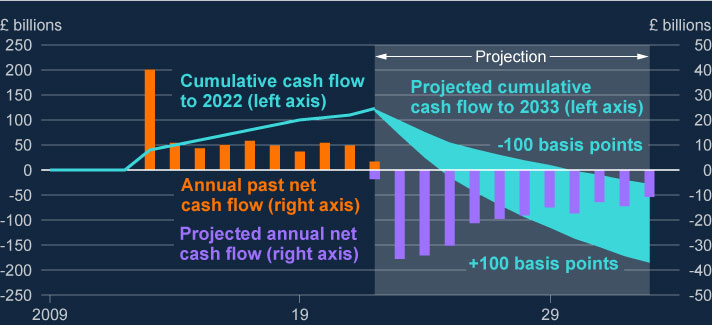

3. **Impact on Retirement Savings**: Taking a loan from your 401k can have long-term implications for your retirement savings. The 401k Loan Calculator Bi Weekly Payments helps you visualize how your loan will affect your overall retirement fund, allowing you to make choices that align with your financial goals.

4. **Flexible Repayment Options**: The calculator can help you experiment with different repayment scenarios. You can adjust the loan amount or repayment period to see how it affects your bi-weekly payments, giving you flexibility in your financial planning.

#### How to Use the 401k Loan Calculator Bi Weekly Payments

Using the calculator is straightforward. Start by entering the amount you wish to borrow, the interest rate (which is typically set by your 401k plan), and the repayment period in months. The calculator will then provide you with your estimated bi-weekly payment. You can adjust the parameters to see how changes affect your payments and overall financial situation.

#### Tips for Making Informed Decisions

1. **Evaluate Your Need for a Loan**: Before taking a loan from your 401k, assess whether it is necessary. Consider other options such as personal loans or credit cards, which may offer better terms.

2. **Consider the Long-Term Impact**: Remember that borrowing from your 401k can reduce your retirement savings. Ensure that you are comfortable with the long-term implications of this decision.

3. **Repayment Planning**: Make a solid plan for repayment. Ensure that your bi-weekly payments fit within your budget to avoid defaulting on the loan.

4. **Consult a Financial Advisor**: If you are unsure about the implications of taking a loan from your 401k, consider consulting a financial advisor. They can provide personalized advice based on your financial situation.

In conclusion, the 401k Loan Calculator Bi Weekly Payments is an invaluable tool for anyone considering borrowing from their retirement savings. By understanding how to use this calculator effectively, you can make informed decisions that will help you manage your finances and secure your financial future. Whether you are facing unexpected expenses or simply looking to leverage your 401k savings, this calculator can guide you through the process, ensuring that your choices align with your long-term financial goals.