Understanding the Benefits and Differences Between Stafford and Perkins Loans for College Students

#### Stafford LoansStafford loans are a type of federal student loan that is available to undergraduate and graduate students. These loans are designed to h……

#### Stafford Loans

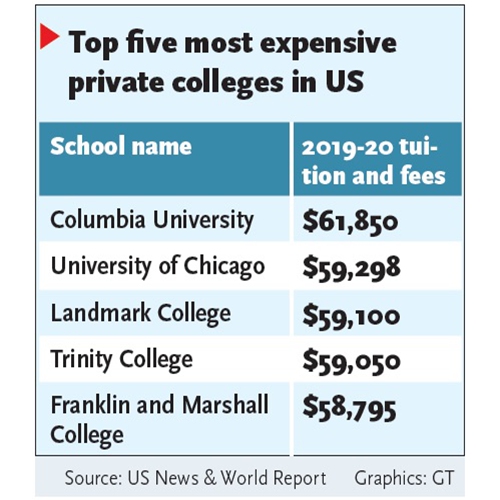

Stafford loans are a type of federal student loan that is available to undergraduate and graduate students. These loans are designed to help students cover the cost of their education, including tuition, fees, and living expenses. One of the significant advantages of Stafford loans is that they offer a fixed interest rate, which means that borrowers can predict their monthly payments over the life of the loan.

There are two types of Stafford loans: subsidized and unsubsidized. Subsidized Stafford loans are awarded based on financial need, and the government pays the interest while the student is in school, during the grace period, and during deferment. Unsubsidized Stafford loans, on the other hand, are available to all students regardless of financial need, but the borrower is responsible for paying the interest from the time the loan is disbursed.

#### Perkins Loans

Perkins loans were another form of federal student aid designed for students with exceptional financial need. Although the Perkins loan program ended in 2017, many borrowers still have outstanding Perkins loans. These loans offered a low fixed interest rate and were subsidized, meaning that the government covered the interest while the student was in school and during deferment periods.

One of the unique features of Perkins loans was that they were administered directly by the college or university, which meant that the amount a student could borrow depended on the institution's funding. Perkins loans were especially beneficial for students attending schools with limited financial resources, as they provided access to low-interest loans that could significantly reduce the overall cost of education.

#### Comparing Stafford and Perkins Loans

When considering Stafford and Perkins loans, it's essential to understand their differences and similarities. Both types of loans aim to make higher education more accessible, but they cater to different student needs. Stafford loans are available to a broader range of students, while Perkins loans are specifically for those with exceptional financial need.

One key difference is the interest rates and repayment terms. Stafford loans typically have slightly higher interest rates than Perkins loans, but they offer more flexible repayment options. For example, Stafford loans have various repayment plans, including income-driven repayment options, which can adjust monthly payments based on the borrower's income.

On the other hand, Perkins loans, while they had lower interest rates, were limited in availability and are no longer being issued. This means that students today primarily rely on Stafford loans for federal student aid.

#### Conclusion

In summary, both Stafford and Perkins loans play crucial roles in financing higher education, but they serve different purposes and student populations. Stafford loans are more widely available and offer various repayment options, making them a popular choice among students. Perkins loans, while beneficial for those with high financial need, are no longer an option for new borrowers.

Understanding the nuances of these loans can help students make informed decisions about financing their education. Whether a student qualifies for Stafford loans or has access to Perkins loans, it's essential to explore all available options and choose the best financial path to achieve their academic goals.