Maximize Your Savings with Our Ultimate Home Loans Mortgage Calculator

#### Home Loans Mortgage CalculatorWhen it comes to purchasing a home, understanding your financial obligations is crucial. This is where a **home loans mor……

#### Home Loans Mortgage Calculator

When it comes to purchasing a home, understanding your financial obligations is crucial. This is where a **home loans mortgage calculator** comes into play. This powerful tool allows potential homeowners to estimate their monthly mortgage payments based on various factors such as loan amount, interest rate, and loan term. By utilizing a home loans mortgage calculator, you can make informed decisions that align with your budget and financial goals.

#### Why Use a Home Loans Mortgage Calculator?

Using a **home loans mortgage calculator** provides several benefits. Firstly, it helps you understand how much you can afford to borrow. By inputting your income, existing debts, and other financial commitments, the calculator can give you a clearer picture of your borrowing capacity. This is essential for avoiding overextending yourself financially.

Secondly, the calculator allows you to experiment with different scenarios. You can adjust the loan amount, interest rates, and loan terms to see how these changes affect your monthly payments and total interest paid over the life of the loan. This flexibility enables you to find the most suitable mortgage option for your financial situation.

#### How to Use a Home Loans Mortgage Calculator

Using a **home loans mortgage calculator** is straightforward. Here’s a step-by-step guide:

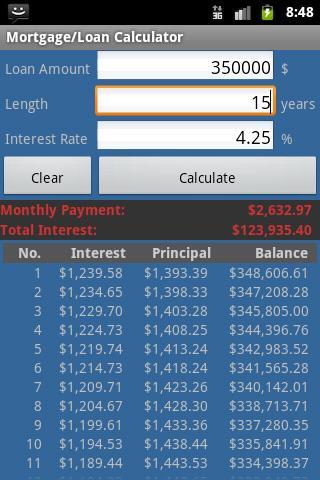

1. **Input Loan Amount**: Start by entering the total amount you wish to borrow. This is typically the purchase price of the home minus your down payment.

2. **Enter Interest Rate**: Input the interest rate offered by your lender. This can vary based on your credit score, the type of loan, and market conditions.

3. **Select Loan Term**: Choose the length of the loan, commonly 15, 20, or 30 years. A shorter term usually means higher monthly payments but less interest paid overall.

4. **Add Property Taxes and Insurance**: Many calculators allow you to include estimated property taxes and homeowners insurance, giving you a more accurate monthly payment estimate.

5. **Review Results**: Once you’ve entered all the necessary information, the calculator will provide you with your estimated monthly payment, total interest paid, and an amortization schedule.

#### Factors to Consider When Using a Home Loans Mortgage Calculator

While a **home loans mortgage calculator** is an invaluable tool, there are some factors to keep in mind:

- **Interest Rates**: Rates can fluctuate based on economic conditions, so it’s wise to stay updated on current trends.

- **Down Payment**: The size of your down payment significantly affects your loan amount and monthly payments. A larger down payment can reduce your monthly burden.

- **Loan Type**: Different types of loans (fixed-rate, adjustable-rate, FHA, VA, etc.) have varying terms and conditions that can impact your calculations.

- **Additional Costs**: Don't forget to account for closing costs, maintenance, and other homeownership expenses that can affect your overall budget.

#### Conclusion

In conclusion, a **home loans mortgage calculator** is an essential tool for anyone looking to buy a home. It empowers you to make informed financial decisions, helping you to understand your borrowing capacity and the implications of different loan scenarios. By utilizing this calculator, you can navigate the complexities of home financing with confidence, ensuring that you choose a mortgage that fits your financial landscape. Whether you’re a first-time homebuyer or looking to refinance, incorporating a home loans mortgage calculator into your planning process can lead to significant savings and a smoother home buying experience.